Already challenged by the breadth and cost of removing lead pipes posing health risks, the U.S. water sector in March braced against another headwind: the U.S. Environmental Protection Agency’s long-expected proposal to regulate a new category of toxins in drinking water.

The proposed National Primary Drinking Water Regulation under the Safe Drinking Water Act calls for setting enforceable regulations for a half dozen per- and polyfluoroalkyl substances (PFAS) — commonly known as “forever chemicals.” With a price tag in the billions of dollars, this new regulation includes requirements for regulatory limits, monitoring, public notification and treatment.

Welcome to a time of unprecedented change in the U.S. water industry grappling with how to respond to ever-shifting rulemaking. Complicating matters is that the EPA’s machinations are providing an impetus for states, advocacy groups, courts and the media to pressure utilities to respond.

Through expert analyses of a survey of roughly 450 U.S. water sector stakeholders — shortly before the EPA’s proposed regulation was released — Black & Veatch’s 2023 Water Report shows an industry at a historic pivot point when it comes to contaminants in drinking water.

Utilities are Well-Informed

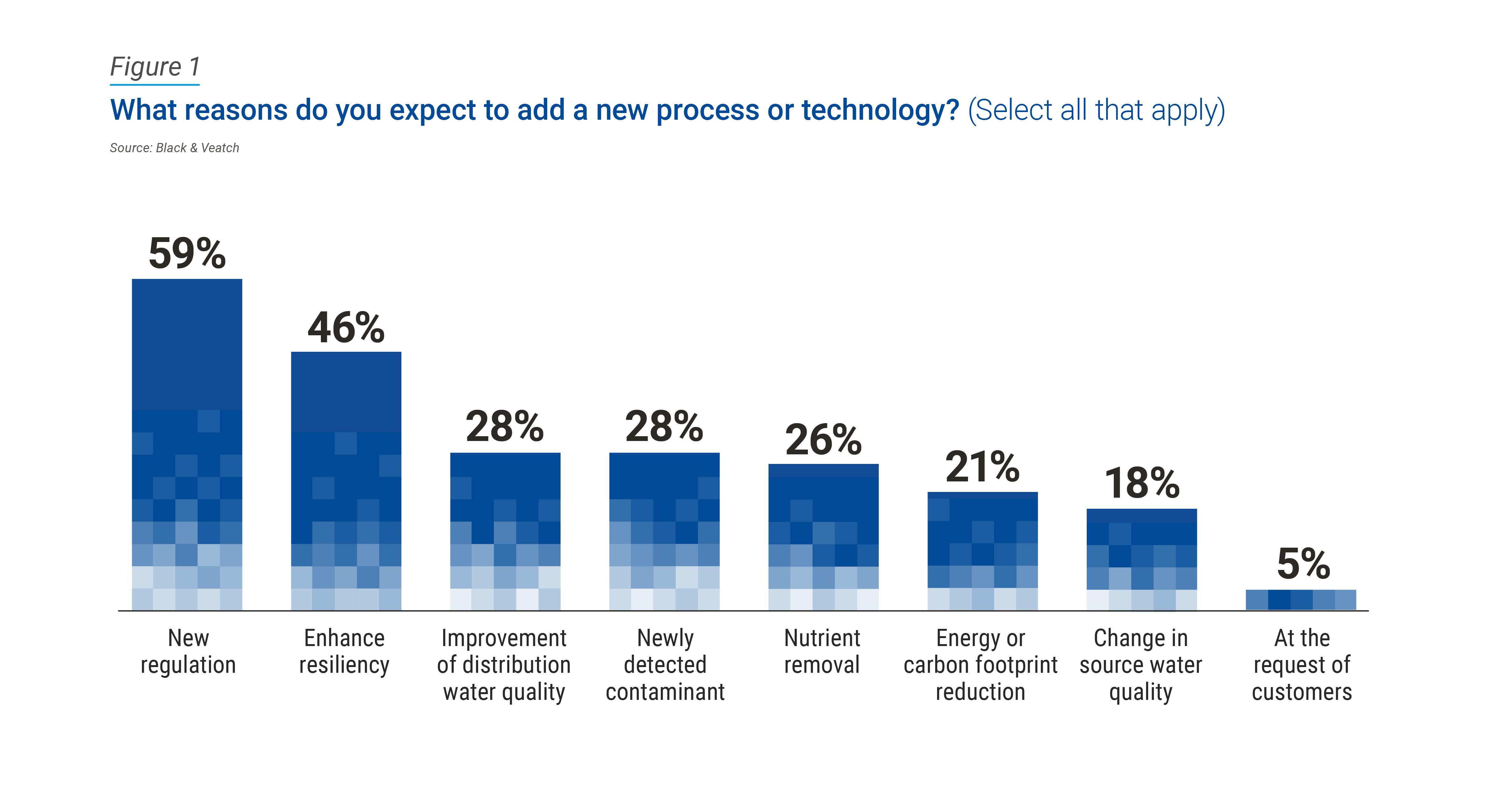

Perhaps taking into account the evolving regulations, both on the state and federal levels, more than half of the survey respondents envision investing in additional treatment processes or significant new treatment technologies, though their time horizons for that vary. Twenty-three percent said that’ll happen within the next two years, with 21 percent expecting it in the next five years. Twelve percent anticipate it coming in the next decade.

A majority of respondents are looking to new processes and technologies chiefly because of new regulations (59 percent) and enhanced resiliency (46 percent), followed by improvement of distribution water quality and a newly detected contaminant, each drawing 28 percent. (Figure 1). Such results appear overwhelmingly positive, demonstrating that utilities have a lot of needs, are well-informed and know where their priorities lay.

To meet the proposed EPA standards for PFAS, the American Water Works Association (AWWA) industry trade group said in March, more than an estimated 5,000 water systems will have to develop new water sources or install and operate advanced treatment. An additional 2,500 water systems in states with existing standards will need to adjust current PFAS treatment systems.

Change is Coming

When asked if PFAS has been detected in their water supply, one-fifth of respondents answered “yes, but we are not treating to remove it because levels are below regulatory limits.” Additionally, roughly three-quarters — 74 percent — either don’t know, have not tested for it, or tested and didn’t not detect it. Just 6 percent say they do have detectable amounts and are treating the water supply to remove it.

These percentages undoubtedly will change over the course of the next two to three years as results of the Unregulated Contaminant Monitoring Rule (UCMR 5) are made public. UCMR 5 requires more than 10,000 water supply utilities to perform quarterly monitoring for 29 PFAS compounds using ultra-low detection limits. UCMR 5 results, paired with the new EPA and state regulations prohibiting PFAS compounds in drinking water above low part per trillion levels, will drive significant new planning and treatment process investment levels.

In March, the AWWA released a cost model study done on its behalf by Black & Veatch that found that the estimated national cost for water systems to install treatment processes to remove PFOA and PFOS to levels required by the EPA proposal would surpass $3.8 billion a year.

"The vast majority of these treatment costs will be borne by communities and ratepayers, who are also facing increased costs to address other needs, such as replacing lead service lines, upgrading cybersecurity, replacing aging infrastructure and assuring sustainable water supplies.” - American Water Works Association

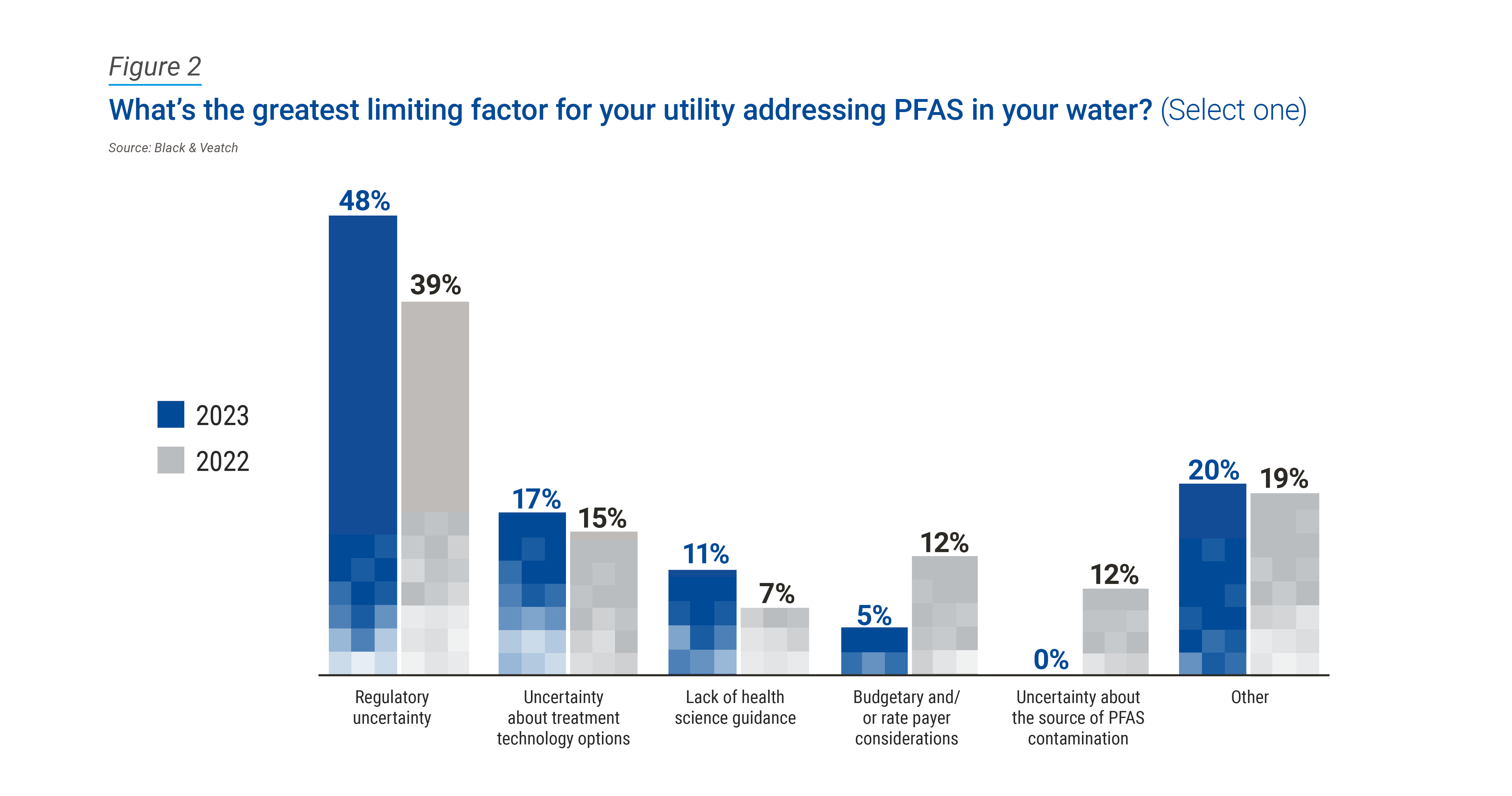

As time wears on, regulatory uncertainty has continued to grow. In 2023, in fact, 48 percent of respondents answered that regulatory uncertainty was their greatest limiting factor in addressing PFAS in their water, up from 39 percent just a year earlier (Figure 2).

These results reaffirm that utilities are unsure about regulations and need more clarity. However, since the EPA’s draft regulations were made public, the 48 percent who answered “regulatory uncertainty” as their greatest hurdle in addressing PFAS might be ready to address that now that the MCLs are out. It is expected that while some of this uncertainty will clear up as the proposed federal standards are finalized, UCMR 5 data will result in yet another round of regulatory activity.

LCRR Compliance Still a Challenge

When it comes to the federal Lead and Copper Rule Revisions (LCRR) — and their perceived biggest challenges to compliance — half of the respondents cited staffing availability, while homeowner response to communications, and lead service line replacement, each drew 43 percent. It’s perhaps noteworthy that compared with 2022, the concern about staffing availability rose while worries about homeowner response and service line mapping decreased. Year over year, roughly one-quarter of respondents cited funding as worrisome.

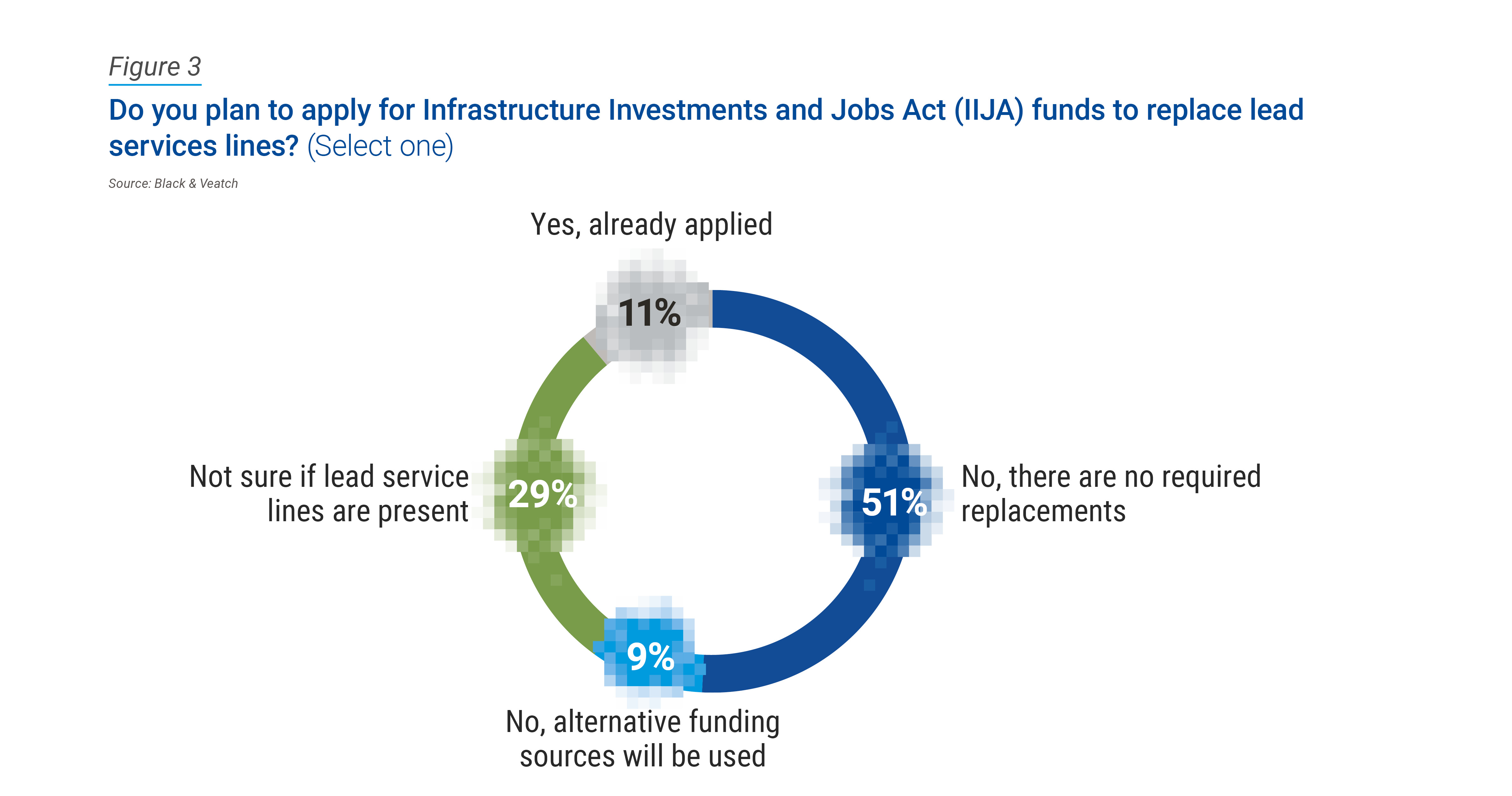

Under the LCRR, the EPA is requiring utilities to start identifying their unknown service lines to confirm whether they’re lead. The EPA’s pending Lead and Copper Rule (LCR) improvements are expected to require utilities to start replacing their lead service lines even if their corrosion control treatment has kept lead levels below the action level. Utilities may be unaware of this; when asked whether they plan to apply for Infrastructure Investments and Jobs Act funds to replace lead service lines, roughly half of respondents — 51 percent — said they would not because there are no required replacements (Figure 3).

Contaminants are Ever-Changing

The issue of contaminants continues to evolve. With historical regulations being set forth, utilities should consider outside guidance as they face the complexities of it all in a sector rife with uncertainty.

Black & Veatch — a global leader in critical human infrastructure solutions — stands poised to partner with utilities to cut through the clutter of the uncertain contaminants landscape and the opportunities that available federal funding presents.