Over the past three decades, nutrient regulations have driven utilities to implement nutrient removal at their facilities in different watersheds across the United States and Canada, including most notably the Chesapeake Bay area around Washington D.C. and Long Island Sound in New York. Currently, nutrient regulations are being implemented in multiple states with waterways that feed into the Mississippi River, aiming to reduce the incidence of hypoxia in the Gulf of Mexico, impacting by U.S. Environmental Protection Agency’s (EPA) estimates 1,232 publicly owned treatment facilities across 31 U.S. states and two Canadian provinces.

In addition, regulations are being developed on per- and polyfluoroalkyl substances (PFAS) — so-called “forever chemicals.” While drinking water is an immediate focus, wastewater and effluent quality needs retain some of the spotlight as regulation sets its sights on the pressing issue.

Per the EPA’s 2023 effluent guidelines plan, a nationwide study will be conducted this year to collect and analyze nationwide data on industrial discharges of PFAS into publicly owned treatment works (POTWs) influent, effluent and sewage sludge. The study inevitably will steer the conversation about continued regulations and future practices while driving utilities to better plan their operations to meet the needs of the EPA guidelines.

Along with PFAS guidelines, nutrient removal remains in play. While in some areas, nutrient removal regulations are in place for some nutrients, there remains uncertainty in future direction of those limits and for other nutrients. Highly populated states such as California, Texas and Florida are rolling out nutrient limits to reduce eutrophication — an excess of nutrients in bodies of water. The San Francisco Bay is looking to implement strict nutrient limits, and in Texas, nutrient limits are starting to be issued to facilities discharging into pristine waters. Florida also recently signed legislation that eliminates direct discharges to the ocean driven by severe algal blooms, resulting in increased reuse efforts.

Black & Veatch’s 2024 Water Report — based on expert analysis of survey results from about 630 U.S. water sector stakeholders — highlights an industry on the cusp of change, waiting for the next regulation to take the wheel of their operations and steer them in the right direction while continuing to manage the changes needed to meet existing challenges.

Regulation as a Reason

Are new regulations a significant factor in moving the needle on improving wastewater treatment to protect human health and the environment? According to survey respondents, notably two-thirds of them, that answer is yes.

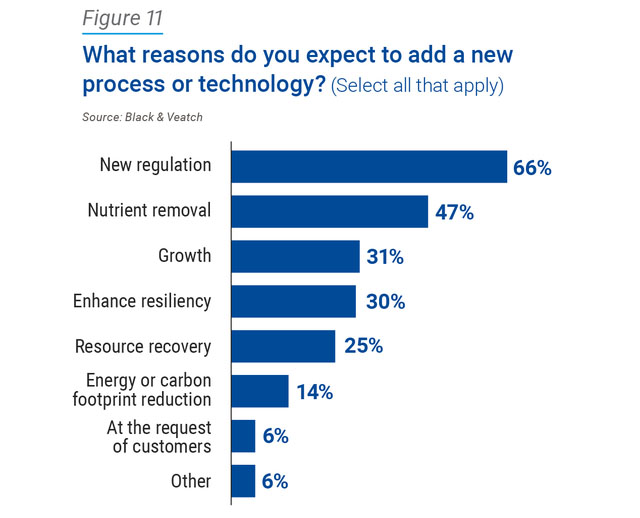

When asked what reasons they expect to add a new process or technology, two-thirds of respondents noted “new regulation” as their top choice, followed by “nutrient removal” (47 percent) and “growth” (31 percent) (Figure 11).

New technology can address PFAS removal and nutrient removal such as nitrogen and phosphorous, support asset management and more. In an age of increased extreme weather events attributed to climate change testing community water systems, one might think that “enhancing resiliency” — or even “resource recovery” — might score more highly in relation to the others, but our survey results showed otherwise. Regulations are the main drivers.

As new regulation provides the push utilities need to get moving on their plans, the EPA is working to survey water stakeholders and provide updated guidelines, and the Clean Water Act from more than a half century ago remains the law of the land.

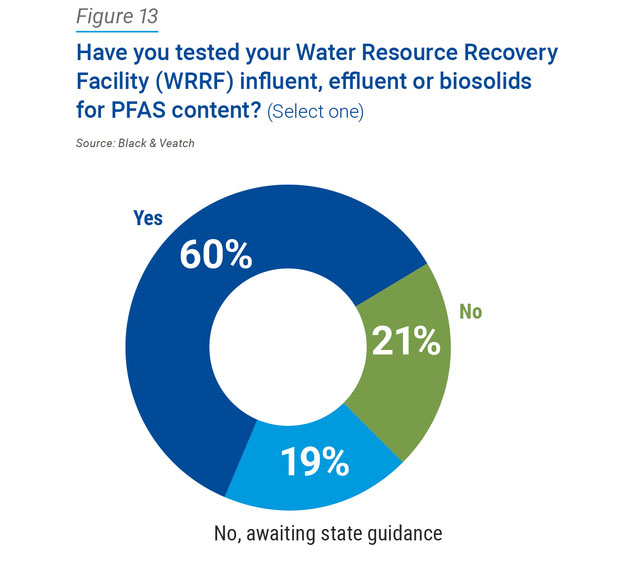

Sixty percent have tested for PFAS at their water resource recovery facility (WRRF), and many respondents suggest that new regulations will be the driver in implementing enhancements. The prospect of an election year brings about uncertainties, especially when it could mean major changes in the EPA. But there is silver lining: many already are thinking about addressing this challenge at their utility and what it means for their communities and the environment.

Wastewater Treatment: An Industry in Limbo

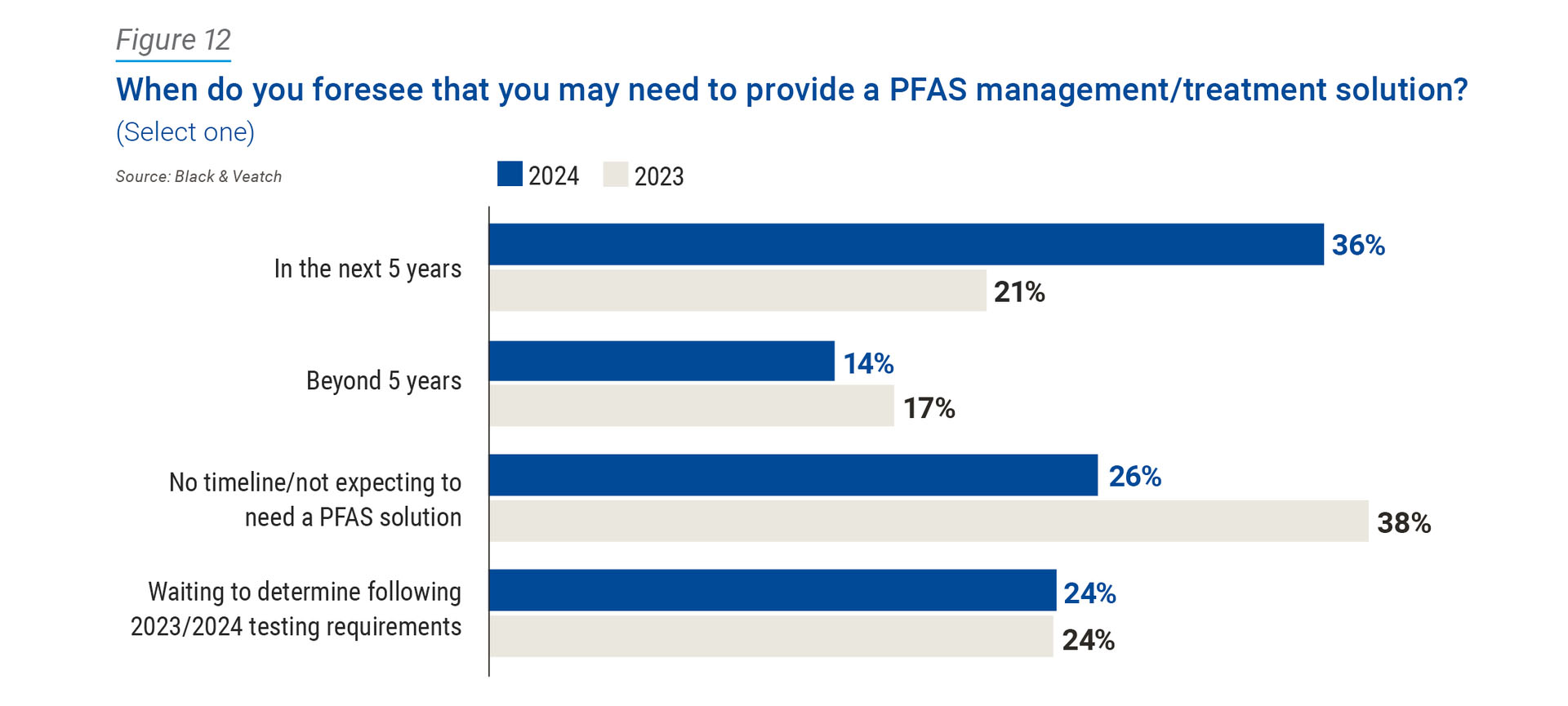

Encountering uncertainty, wastewater treatment plants are looking ahead to PFAS mitigation strategies, and it may be sooner rather than later. When survey respondents were asked when they foresee the need to provide a PFAS management/treatment solution, 36 percent responded “in the next five years,” a 15 percent jump from 2023. The number of respondents with no timeline decreased from 38 percent to 26 percent (Figure 12).

Notably, one in four (24 percent) of respondents remained consistent in their stance to wait until 2023/2024 testing requirements. About one quarter of utilities seem to be in limbo, ensuring their efforts to manage and treat PFAS are worthwhile. And while almost 40 percent know they will be dealing with it in the next five years, the uncertainty remains steady for the other 50 percent, with no timeline or plans to wait.

When uncertainty abounds regarding PFAS, the rumor mill begins turning, leaving utilities asking when the regulations will be at play and exactly how low the limit will be. Without definite numbers and concrete regulation, wastewater treatment facilities are left in the dark about future regulations, operating without knowing what plans to make, and creating uncertainty on the funding required to make any changes.

When survey respondents were asked if they have tested their WRRF influent, effluent or biosolids for PFAS content, a strong 60 percent said yes, leaving the remaining 40 percent responding no and/or that they are “awaiting state guidance before they sample” (Figure 13). Without the data, plans for removal and treatment cannot be made.

Wastewater facilities may be stuck between a rock and a hard place. The EPA’s 50-year-old Clean Water Act seeks to regulate and ensure healthy effluent water guidelines, but without the proper updates to limitations and treatment, utilities are tasked with managing their own treatment plants and hoping for the best — or they are stuck in limbo, awaiting an uncertain future.