While drinking water safety typically is drowned out by more controversial political issues in an election cycle, public awareness of emerging waterborne contaminants — and the newly established federal regulations — should make the calls for improved water treatment infrastructure loud and clear across both sides of the aisle in 2024.

In April, the federal government announced a regulatory limit for all municipal water systems for six perfluoroalkyl and polyfluoroalkyl substances, known collectively as PFAS or “forever chemicals.” At the same time, utilities are still weighing options for complying with the EPA’s Lead and Copper Rule Revisions that, by October 2024, would require establishing and maintaining an inventory of water service line materials.

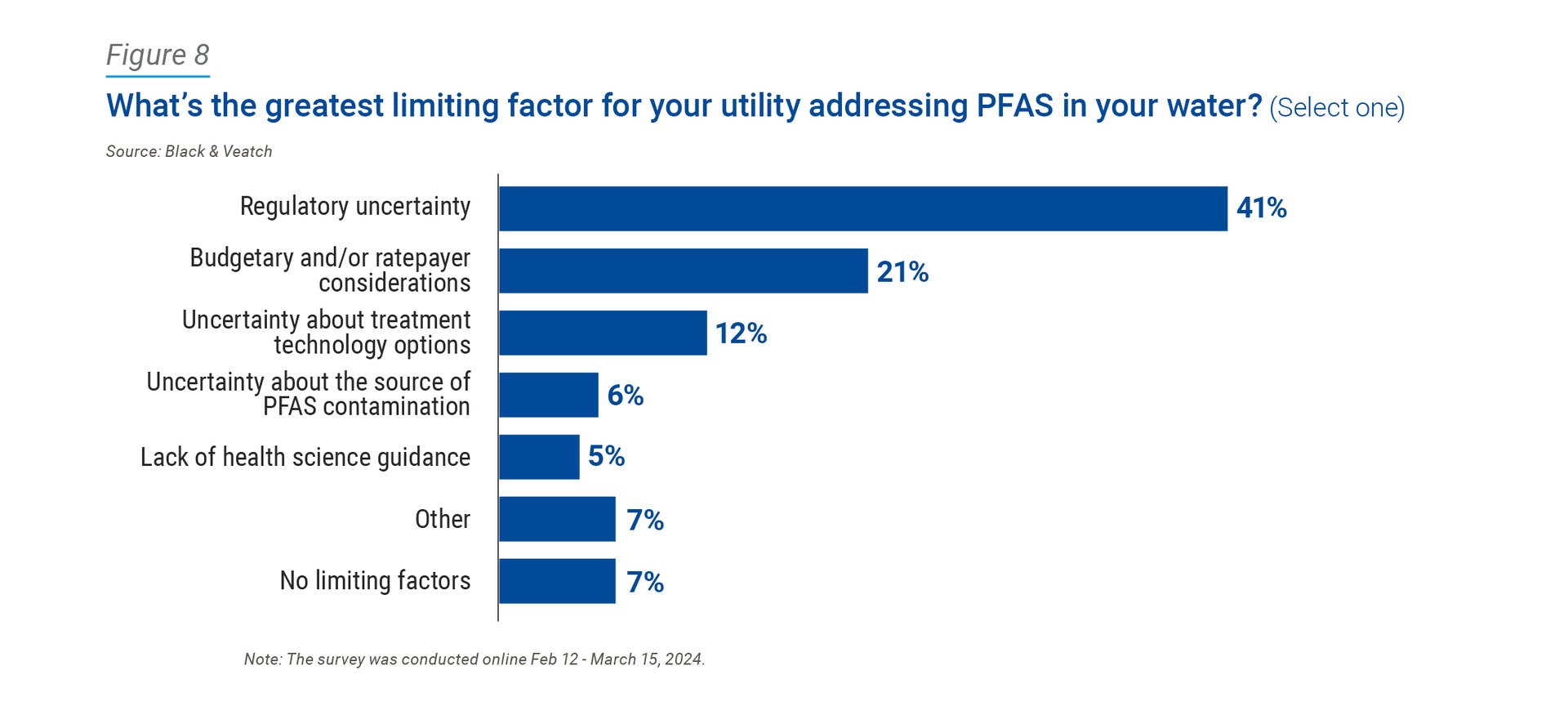

Black & Veatch’s 2024 Water Report — based on a survey of nearly 630 U.S. water sector stakeholders — showed that for the third year in a row, respondents reported regulatory uncertainty as the greatest limiting factor for addressing PFAS in water. But that survey was conducted from mid-February through early March, before the EPA’s April announcement about the new regulations. At 41 percent, though, that concern was down 7 percentage points from 2023 (Figure 8).

Given the release of the final drinking water regulation this year, it remains to be seen if utilities will be confident in their regulatory requirements going forward, or if uncertainty will continue due to other evolving regulations such as proposed changes under the Resource Conservation and Recovery Act (RCRA).

At the same time, water stakeholders’ worries about budgetary and/or ratepayer considerations when it comes to PFAS jumped significantly from 5 percent in 2023 to 21 percent in 2024. This makes sense, as the U.S. EPA’s proposed National Primary Drinking Water Regulation (NPDWR) was announced in March of 2023, likely prompting concerns about the cost of compliance. Although different contaminants, it also could reflect burgeoning knowledge about costly pipe replacements necessary to meet the EPA’s Lead and Copper Rule Revisions over the next decade, which would certainly add pressure to already strained budgets.

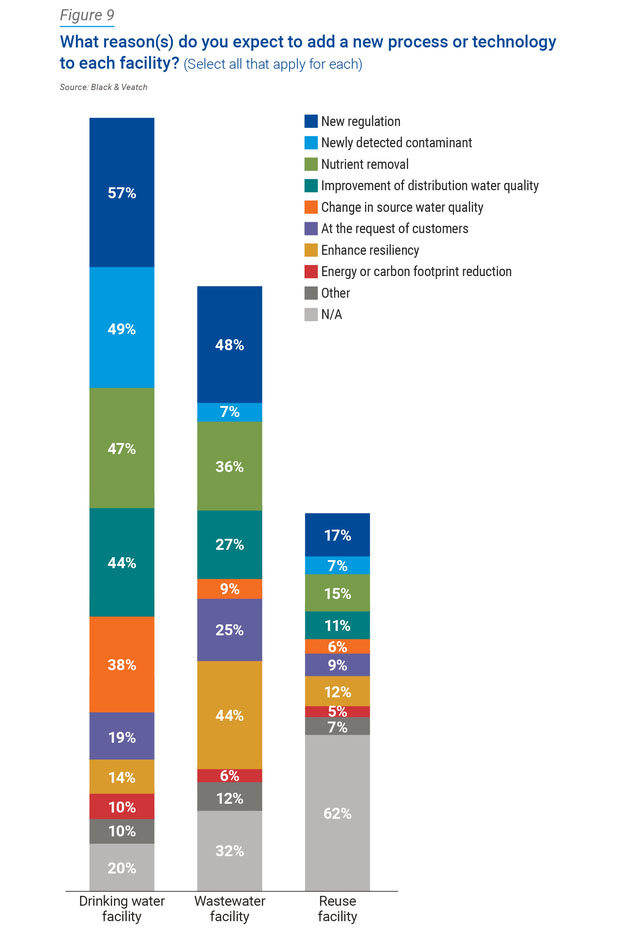

Of the reasons stakeholders said they expected to add a new process or technology to their drinking water facilities, “new regulation,” “enhance resiliency,” “improvement of distribution water quality” and “newly detected contaminant” again made the top of the water survey’s list (Figure 9).

Waterborne Disease

The increase in responses about newly detected contaminants largely could be attributed to more awareness of potential PFAS and lead contamination; however, that response, along with the rise in concern over distribution water quality, might reflect a March report from the Centers for Disease Control and Prevention. Of U.S. waterborne disease outbreaks from 2015 to 2020, the report found that drinking water exposures caused 2,140 illnesses, 563 hospitalizations and 88 deaths. Legionella, which causes potentially fatal Legionnaires’ disease, was the leading cause of outbreaks. That bacteria can grow in piping systems of office buildings, hospitals and cruise ships, and they affect people through inhalation of aerosolized water droplets.

At a time when aging water infrastructure is causing more illness and resulting in the lack of our most basic, life-sustaining necessity — for example, a water treatment plant failure in summer 2022 that left more than 150,000 people without safe drinking water for weeks — ratepayers and politicians seem just as focused on headline-grabbing PFAS regulations. Along with the Lead and Copper Rule, the final national primary drinking water regulation for PFAS is the biggest drinking water regulation of the past decade.

It also could be the costliest, with PFAS treatment solutions in the United States potentially exceeding $3 billion annually, according to a Black & Veatch study conducted for the American Water Works Association. The costs could be a major hurdle for water utilities and ratepayers across most states and municipalities, which already are struggling with funding uncertainties, staff shortages and other headwinds facing the nation’s aging water systems. While compliance could be difficult, the dangers to public health could come at much higher costs.

Water Treatment Solutions

PFAS treatment investments should balance several factors, including treatment goals, water quality and how PFAS treatment technologies could complement existing infrastructure and operational needs. Remediation in drinking water can be accomplished through ion exchange, granular activated carbon adsorption, nanofiltration and reverse osmosis. A bench scale test or pilot test helps determine which treatment technology is best.

With today’s technology, it shouldn’t take one to three years to bring safe drinking water to communities across the country. Modular treatment solutions also have emerged as a viable short-term option for complying with PFAS regulations in time-sensitive or emergency situations. Following upfront testing and assessments, modular units can be delivered by vehicle and deployed in compact configurations. Each can treat up to 4 million gallons of water per day, and multiple units can be deployed at the same time for higher treatment flows. The temporary solutions are relocatable once water utilities have permanent PFAS remediation technologies in place.

PFAS in Wastewater, Biosolids

Although PFAS treatment options are available for drinking water, the industry should brace for yet another challenge on the horizon: PFAS in wastewater. One potentially overlooked aspect of PFAS contamination that could make solutions for future drinking water treatment and regulation murkier is the release of PFAS chemicals into waterways following wastewater treatment processes and biosolids production. By the end of 2024, the EPA is expected to release the results of a biosolids risk assessment for two PFAS compounds, after which it plans to decide whether PFAS management in biosolids is necessary.

Although there are no regulations limiting PFAS release from wastewater treatment facilities, lawsuits throughout the country could further bring wastewater treatment operations under the EPA’s microscope. In Georgia, a federal lawsuit alleges that one city allowed a land company and water control plant to release PFAS into a river’s watershed, contaminating the county’s drinking water through sludge disposal operations, according to several reports. Similarly, farmers are suing a biosolids management company for allegedly high levels of PFAS in the fertilizers it produces from sewage sludge; that lawsuit claims contaminated water killed livestock and decreased property values. Maine has banned land applications of biosolids. Regardless of regulation status, individuals and businesses are demanding action around keeping their waterways clean.

Lead and Copper Rule

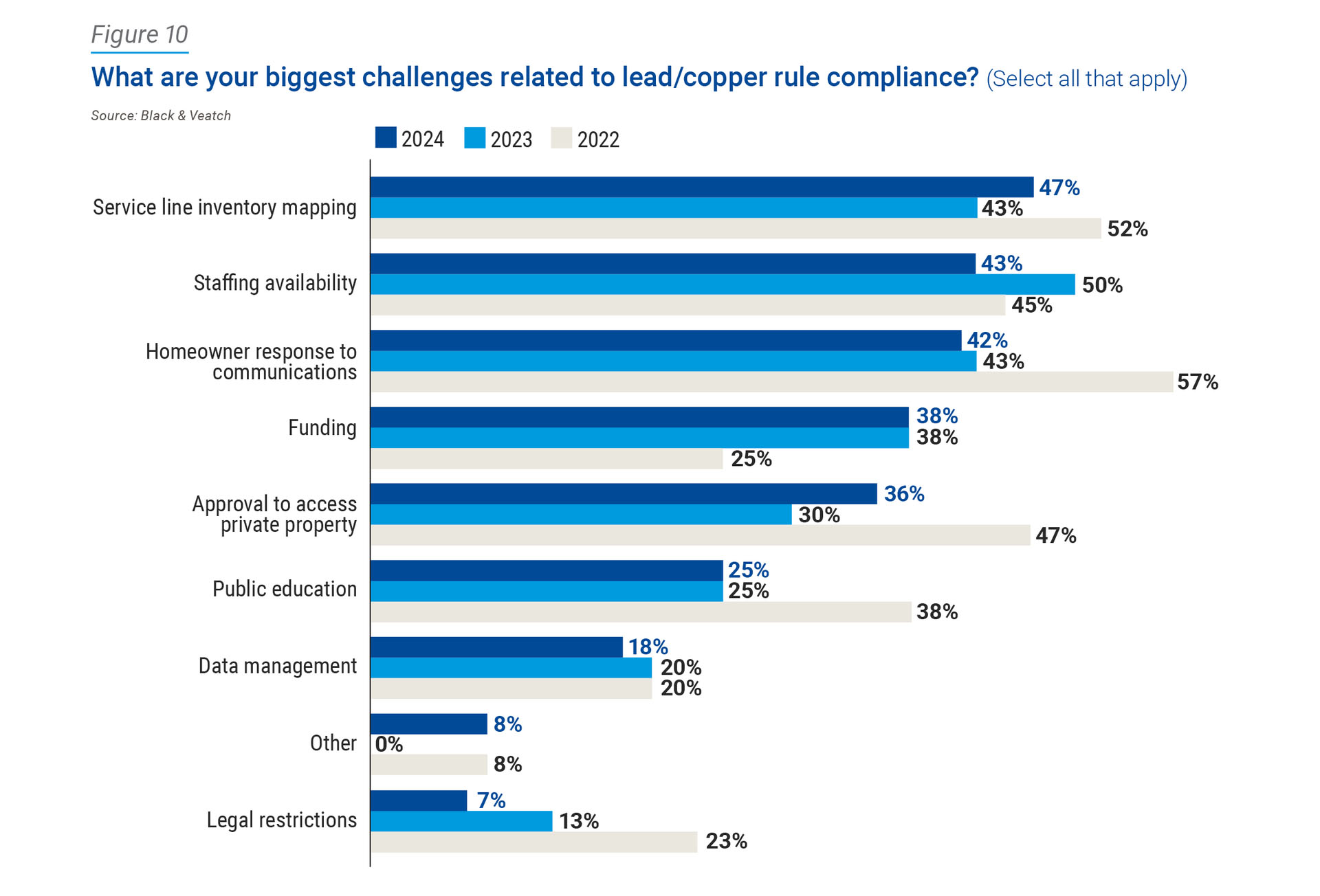

Finally, when it comes to the biggest challenges water stakeholders said they were facing related to the Lead and Copper Rule Revisions, service line inventory mapping (47 percent) took the top spot this year over staffing availability (43 percent), which was the biggest concern in 2023 (Figure 10). The result suggests water utilities are most concerned about how they’re going to meet the EPA’s deadline for establishing and maintaining an inventory of lead water service lines by October 2024. Some of this worry could be attributed to unknowns existing on the customers’ side of water meters as there was an increase in the difficulty to gain approval to access private property (up to 36 percent from 30 percent in 2023) as the inventory deadline approaches.

Although there has been uncertainty about whether state regulators will accept statistical processes that estimate inventory materials, predictive modeling could help utilities minimize the amount of unknown service line materials in their systems. It’s an especially efficient data collection mechanism for utilities faced with gathering hundreds of thousands of data points.