The increasing pressure on water networks is real: over-allocation, increased demand, consequences of climate change, chronically aging infrastructure and an ever-aging workforce, and a shifting regulatory landscape continue to challenge water utilities and the communities and businesses they serve. Enter the promise and opportunity of digital water solutions, which have the power to transform the water sector, putting to use technology that provides new digital capabilities to meet these needs.

Utilities that maximize digital solutions are better equipped to transform data into actionable knowledge, achieve a higher return on investment and make better business decisions, getting the most out of their aging assets in the interest of resilience. While acknowledging that there’s a learning curve to navigate, seizing the opportunity begins with knowing what’s possible with technology.

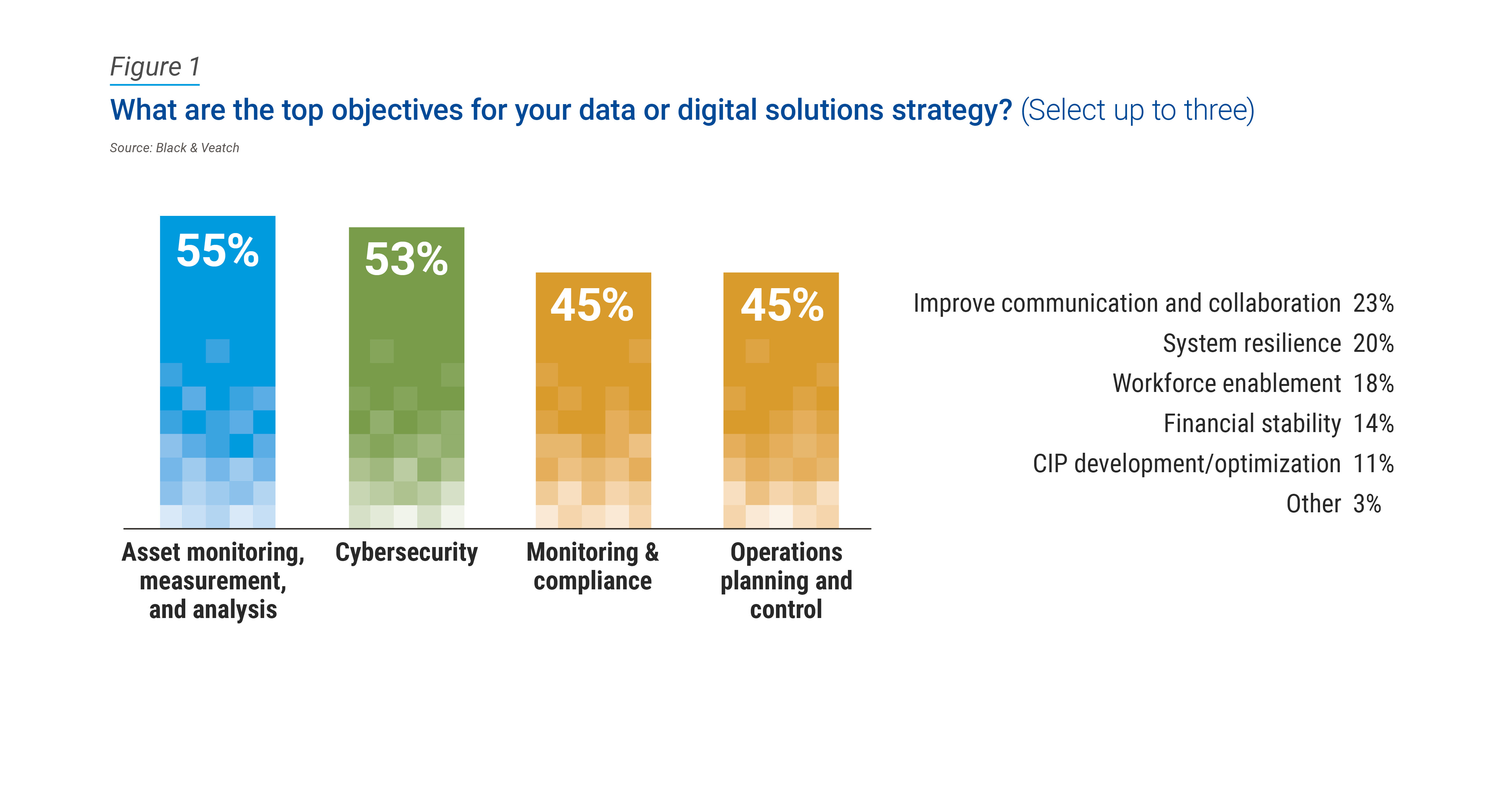

Black & Veatch’s 2023 Water Report, based on a survey of roughly 450 U.S. water sector stakeholders, shows encouraging evidence that the industry is undergoing a digital transformation, with utilities having a digital water strategy in place and clear objectives defined. Top objectives of data and digital solutions among respondents include asset monitoring, measurement and analysis (55 percent), cybersecurity (53 percent), monitoring and compliance (45 percent) and operations planning and control (45 percent) (Figure 1). Utilities are potentially seeing immediate benefit from the application of digital solutions in these areas.

Drilling deeper into the survey’s data, when asked to what extent their company’s data or digital solutions strategy is achieving objectives, two-thirds of respondents — 65 percent — reported positive results. Forty-two percent stated they are achieving some strategic objectives, while one in five respondents said they are meeting most strategic objectives. Just 3 percent reported they are meeting all their strategic goals.

When it comes to data management practices, more than half — 54 percent — of respondents stated that while they are collecting data, they are not leveraging it effectively, a slight increase from 49 percent last year.

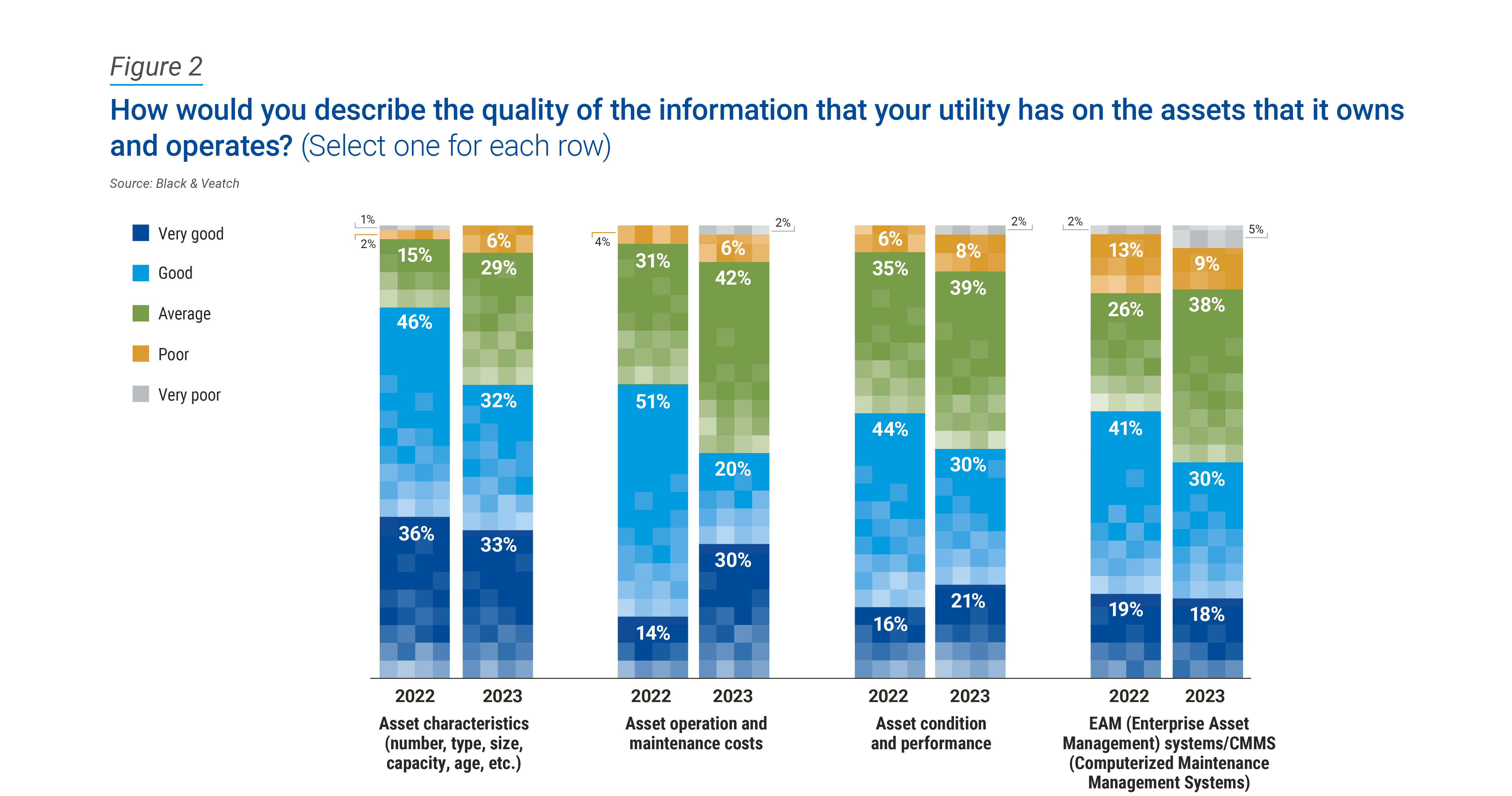

Even amid the lag in optimizing use of their data, respondents asked to characterize the veracity of the information their utility has on its assets offered a mixed picture. Half assessed their data about their asset operation and maintenance costs as very good or good — down from 65 percent in 2022 — while categorization of such numbers tied to asset condition and performance were 51 percent, 9 percentage points lower than the previous year. Respondents who assessed their information as average increased appreciably year over year (Figure 2).

Elsewhere on the technology front, when asked to rate their level of expertise with different types of digital solutions, the top four responses involved solutions that have been in existence for some time — geographic information systems, customer data and information, computerized maintenance management systems, and automated meter reading or advanced metering infrastructure. This could illustrate that these continue to be the predominant forms of digital solutions in practical application within the industry. Unsurprisingly, utilities report a low level of expertise around next-generation digital solutions such as building information modeling, data science, artificial intelligence (AI) and digital twins. Or it could indicate they either aren’t aware of other technologies and don’t have resources to help, or they’re not putting enough emphasis on technology that could have a profound impact, given that it isn’t as familiar.

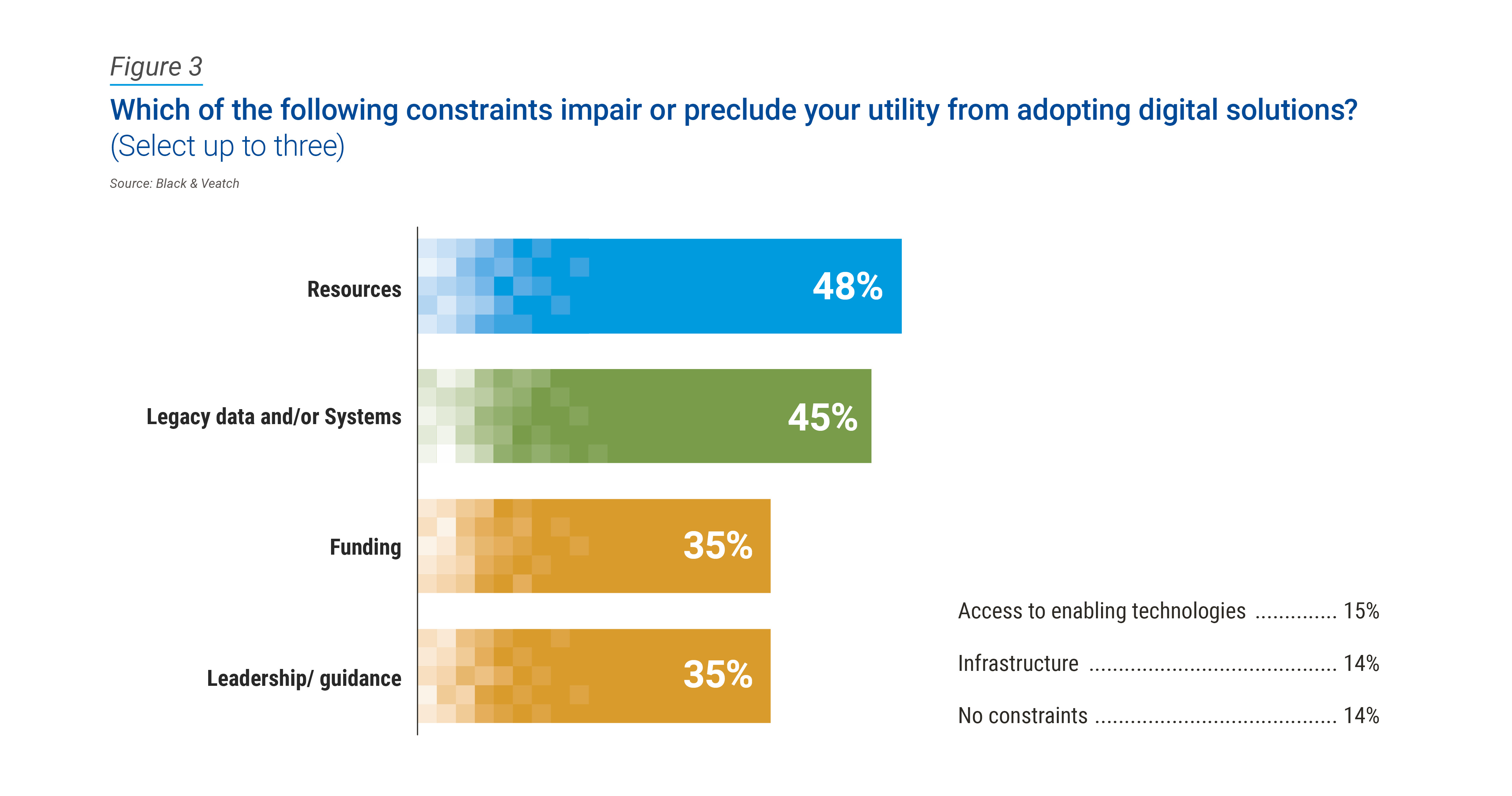

When asked what is holding them back from adopting new digital solutions, resources (48 percent), the use of legacy data and systems (45 percent), funding (35 percent) and leadership or guidance (35 percent) topped the list (Figure 3). Until these facets are in place, utilities will not unlock the true value of digital that utility industries and other industries have.

While there’s no denying the perceived complexities of these solutions, utilities are missing out on opportunities by not leveraging them. In fact, the next-generation digital solutions that utilities report the lowest level of expertise hold the most significant promise for improvements in areas they ranked of high importance, including asset management and monitoring. This illustrates a gap in education and awareness around these solutions and its capacity to help utilities successfully deploy and leverage them.

For many public providers and private industries, digital water represents a path to achieving financial, community and sustainability objectives, though the path isn’t always clear. Opportunity abounds for tomorrow’s workers to become experts in the digital water technologies that hold the most sway in transforming the sector.

When utilities further develop their plans and capabilities to do more with their data through digital solutions, they can exploit this knowledge into more efficient decision-making to face the difficulties of resilience, sustainability, and aging infrastructure and workforce. And the time for that is now.