From U.S. electric utility boardrooms to the power plant control rooms, it’s a time of disruption. The kind that comes with an onslaught of headwinds in a sector engaged in evolution.

From California’s Pacific coast all the way to Maine’s Atlantic and all points in between, megatrends – everything from decarbonization to sustainability, electrification and climate change resilience – increasingly are driving discussion about the imperative of a modernized grid – “grid mod” in the sector’s parlance.

On the generation side, climate-friendlier renewable energy continues its unabated surge (U.S. wind generation capacity jumped by 42 percent between 2019 and 2023), forcing electric utilities to accommodate it onto a chronically aging grid. As coal-fired power plants continue to fall into disfavor and are retired, nuclear power is enjoying the nascent stages of a potential revival.

Cyber threats by criminals and various nationstates that expose gaps in utility defenses are growing, stoked by the attackers’ advancing sophistication and the vulnerabilities that come with broadening digital networks and the demands of the Industrial Internet of Things (IIoT). Evolving regulations continue to roil uncertainty and dampen investment in an upgraded grid that, among other things, meets the immense power needs of proliferating data centers – including simple updates by software companies that cause significant disruptions – as well as GenAI and cloud computing. With more companies and communities pursuing clean energy and transportation solutions to serve their near-term decarbonization goals, practical and tactical plans with intensifying scope and ambitions become more paramount.

Black & Veatch’s 2024 Electric Report – drawing upon expert analyses of a survey of nearly 700 U.S. energy industry stakeholders – tells the story of an electric industry navigating a sea of challenges along with great opportunity, always mindful that in many ways it’s a matter of budgets and funding.

Renewables and the Grid

Renewable energy continues to drive capacity in new U.S. energy markets, with solar power the fastest-growing source of new electricity generation nationwide. The reasons are many, largely driven by fundamental economics of renewable energy. In addition, customer decarbonization goals, the continued declining costs of photovoltaic cells, tax credits and other policies make renewables an unstoppable force.

Last year, the electric sector began operating 19 gigawatts (GW) of new utility-scale solar photovoltaic generating capacity, up 27 percent from 2022. That growth comes despite the downside that solar and wind power are prone to intermittency – the lack of energy produced when the sun isn’t shining and the wind isn’t blowing – and must be paired with batteries or other energy storage types. The U.S. Energy Information Administration (EIA) has forecasted that by 2050, solar and wind power will account for 40 to 69 percent of U.S. electricity generation. It appears the industry has leveled off at roughly 20 GWs per year.

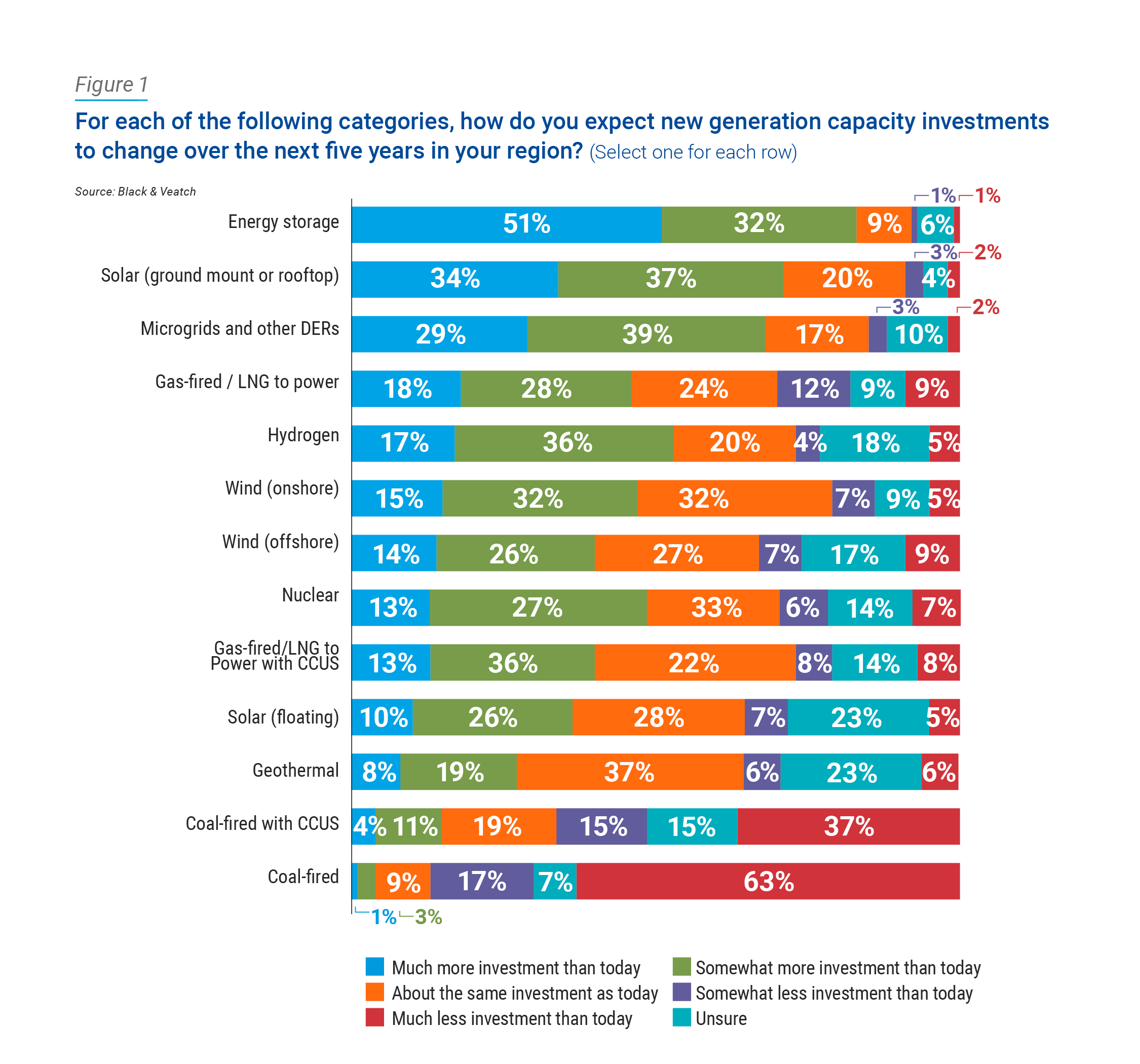

Utilities see it coming. When asked how they expect new generation capacity investments to change over the next five years in their service territories, half of respondents – 51 percent – anticipate energy storage in need of “much more investment than today,’’ followed by ground-mounted or rooftop solar (34 percent), microgrids and other DERs (29 percent) (Figure 1).

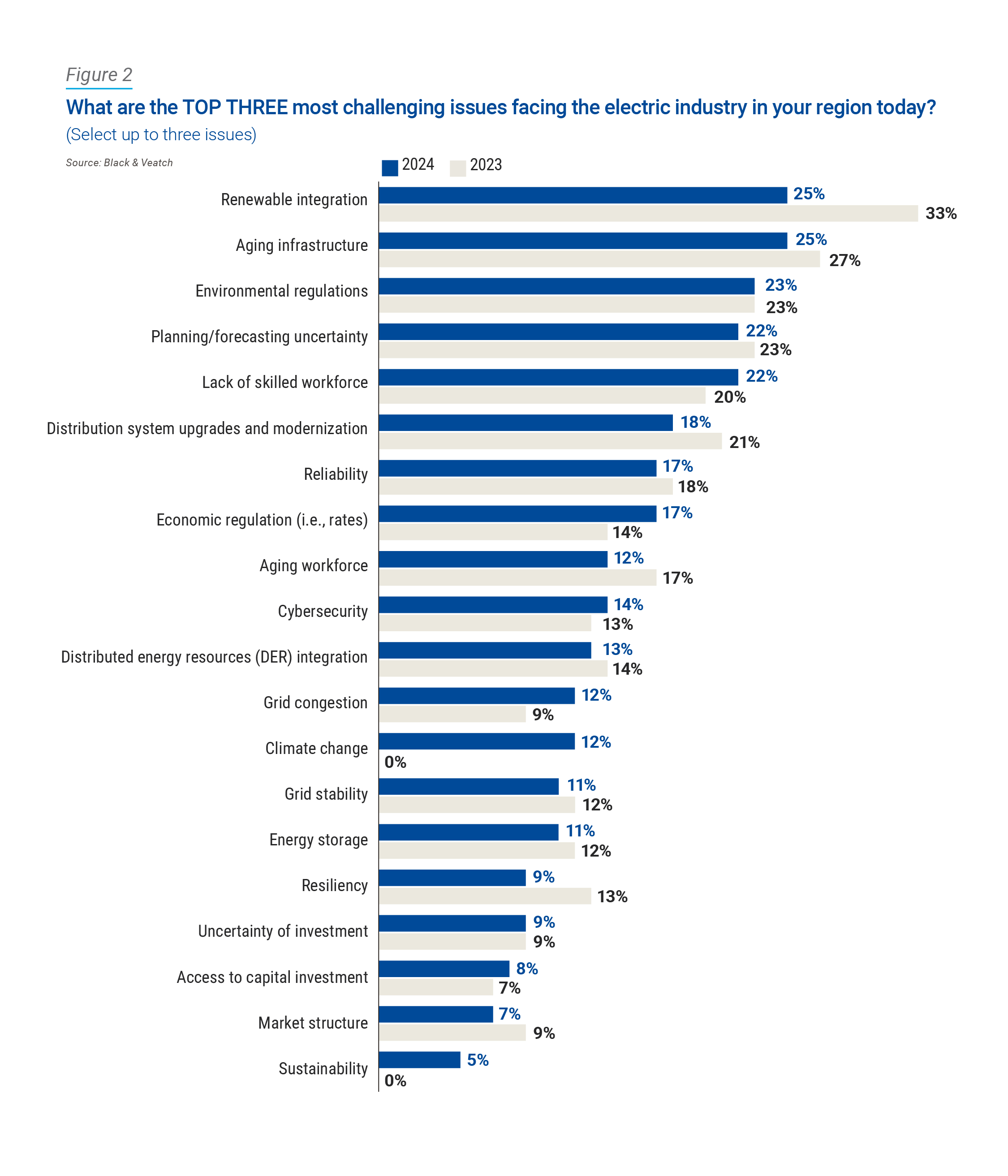

Accommodating all that renewable energy onto the grid is a major headwind, with one in four respondents again characterizing that as the U.S. power sector’s foremost challenge, tying it with the incessant headache that is aging infrastructure.

Environmental regulations, planning and forecasting uncertainty, and the lack of a skilled workforce were the only other issues that drew at least 20 percent. Of note: workforce issues – the lack of a skilled workforce, along with its aging employees – accounted for a combined 36 percent of responses (Figure 2).

Resilience and Reliability: The Need for Grid Mod

Talk of upgrading and hardening the grid has been a hot topic for decades, and the calls for such change in the name of greater resilience are growing louder, knowing that reliable service always has been a core of every utility’s mandate. Unquestionably, utilities recognize the need to be more resilient than ever.

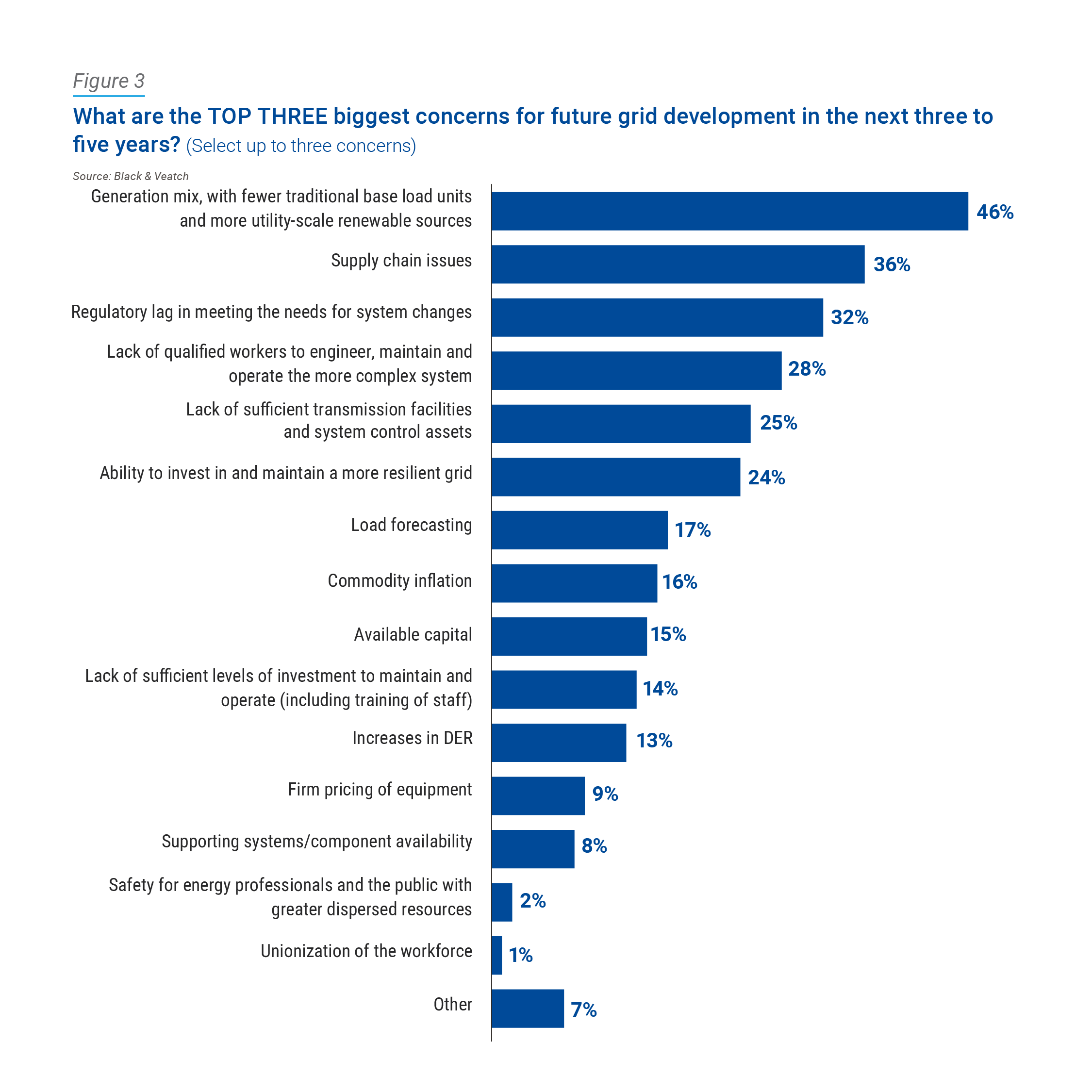

So, what’s crimping future grid development in the short term of the next three to five years? Nearly half of respondents – 46 percent – cite the generation mix, with more utility-scale renewables and fewer traditional base load units. Supply chain bottlenecks (36 percent) in trying to procure what’s needed to build out a modernized grid, regulatory lag in

addressing the needs for system changes (32 percent), and the shortage of qualified workers to design and run more complex systems follow (Figure 3).

With the push and pull of competing interests, many things on the industry’s “to-do” list are nowhere close to cheap. So, who’s going to pay for it? Under today’s regulatory models, utilities typically don’t have a way to recapture all the fixed costs required for critical upgrades, and ratepayers are likely to object to chipping in more for their electrons, making it even more paramount for utilities to present a thoughtful case to regulators – or seek out outside guidance from companies such as Black & Veatch to help make that happen.

Cybersecurity

As power utility IT and OT networks grow in technological complexity and sophistication, so are the cyber criminals looking to attack it as everwidening use of internet-connected components expand the potential attack surfaces, exposing vulnerabilities in grid security. It’s a high-stakes chess match pitting cyber invaders against power plant systems as the sentries guarding the gates.

The IT threats are diverse and potentially devastating, with survey respondents deeming phishing attacks (69 percent) and ransomware and malware (both at 45 percent) as the most concerning. Meanwhile, seven in 10 respondents report at least some level of confidence in their utility’s ability to recover from a cybersecurity attack, but that’s merely reactive after the intrusion already has happened and, unfortunately, the damage is done.

The bigger concern likely is the level of confidence in preventing an attack. Topping the list of efforts utilities see most essential in mitigating cybersecurity risks are threat intelligence (36 percent), monitoring and response (34 percent), vulnerability assessment and management (31 percent) and an incident response plan (25 percent).

When it comes to cybersecurity, nothing is easy. The regulatory landscape is constantly shifting and maturing, hoping to keep step with emerging risks through new and evolving minimum compliance standards. Grid-modernizing efforts will spur more connectivity, broadening potential vulnerabilities. And, once again, it takes money to fortify, thoroughly adopt and consistently monitor cyber protections while making needed investments in robust risk assessments and the latest technologies.

As with so many other things on the plate of U.S. power utility stakeholders, it all starts with a plan that makes headway in incremental, manageable bites. Reshaping tomorrow’s more resilient grid means being proactive now.