Sustainability programs are embracing a spectrum of topics — from conservation and resilience to reuse, better efficiencies and new technologies — all integral to water stewardship. All of it is punctuated by the fact that water is a finite resource and an increasingly pressing global concern.

A legion of variables are complicating matters. The ever-aging infrastructure of the U.S. water and wastewater sectors is strained through more frequent extreme weather events such as droughts and floods. The unabated growth of urbanization with more development, along with digitization leading to the development of water-intensive data centers, is stoking rising demand for reliable water supplies.

The critical question: Where are water utilities in their sustainability and decarbonization journeys? Black & Veatch’s 2024 Water Report, with expert analyses of survey responses from nearly 630 U.S. water sector stakeholders, offers answers about how the complex water industry perceives sustainability and tracks its progress in a world eager to dramatically reduce carbon emissions.

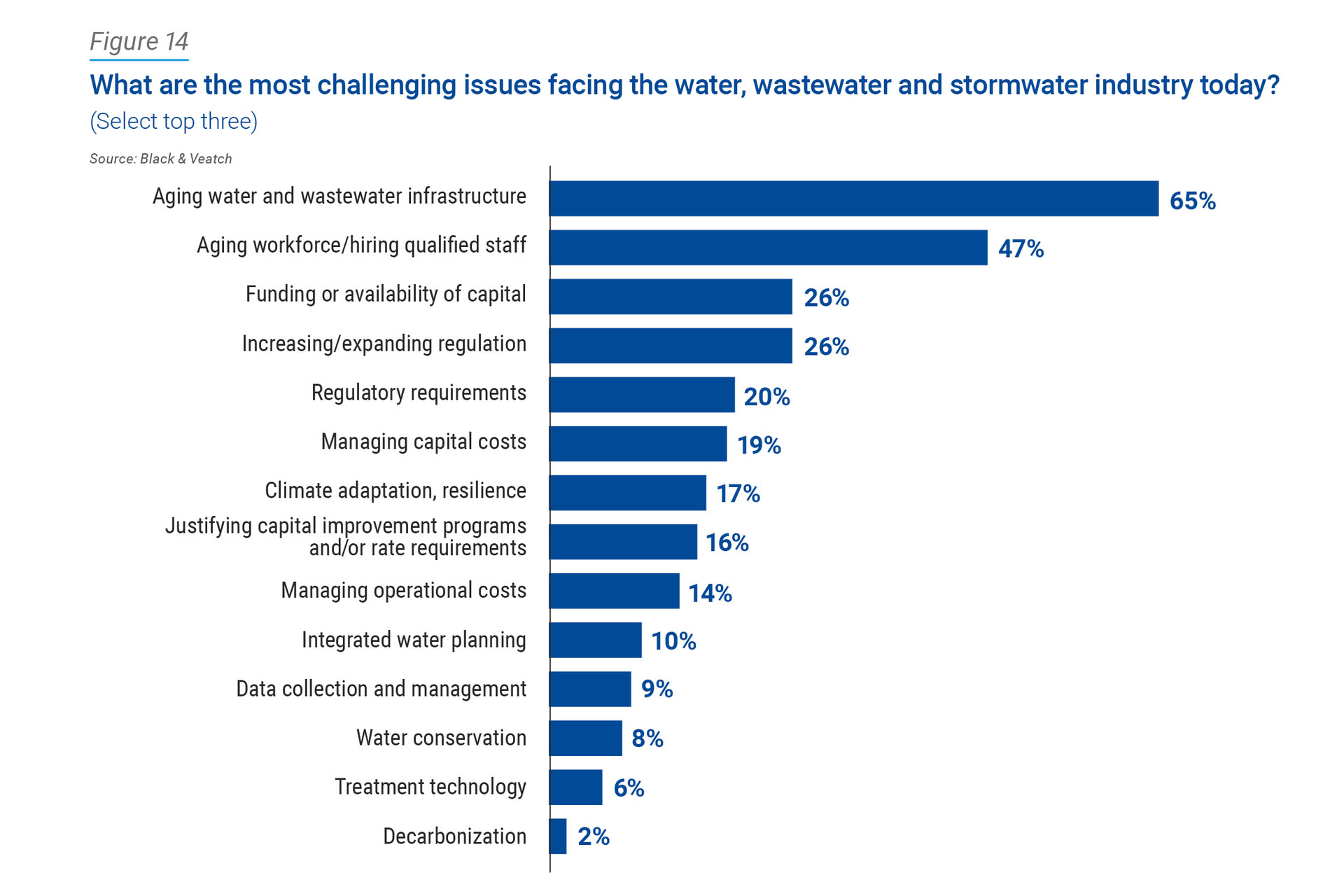

To little surprise, aging infrastructure again tops the list of challenges cited by more than six in 10 respondents, followed by an aging workforce and the hiring of qualified staff (47 percent, down from 51 percent last year and 64 percent in 2022, when the COVID-19 exacerbated the issue in prompting retirements) (Figure 14).

Advancing sustainability and decarbonization initiatives often is a matter of money — or the relative lack thereof. Respondents cited funding or availability of capital as their third largest concern, at 26 percent tied with increasing or expanding regulation. Managing capital costs (19 percent), justifying capital improvement programs or rate requirements (16 percent) and managing operational costs (14 percent) rounded out the top nine.

Amid the global worries and vigilance about climate change and its impacts on water supplies, climate adaptation and resilience — a new response choice in this year’s survey — found itself in the middle of the pack (17 percent), illustrating its ascension in the consciousness of U.S. water sector stakeholders.

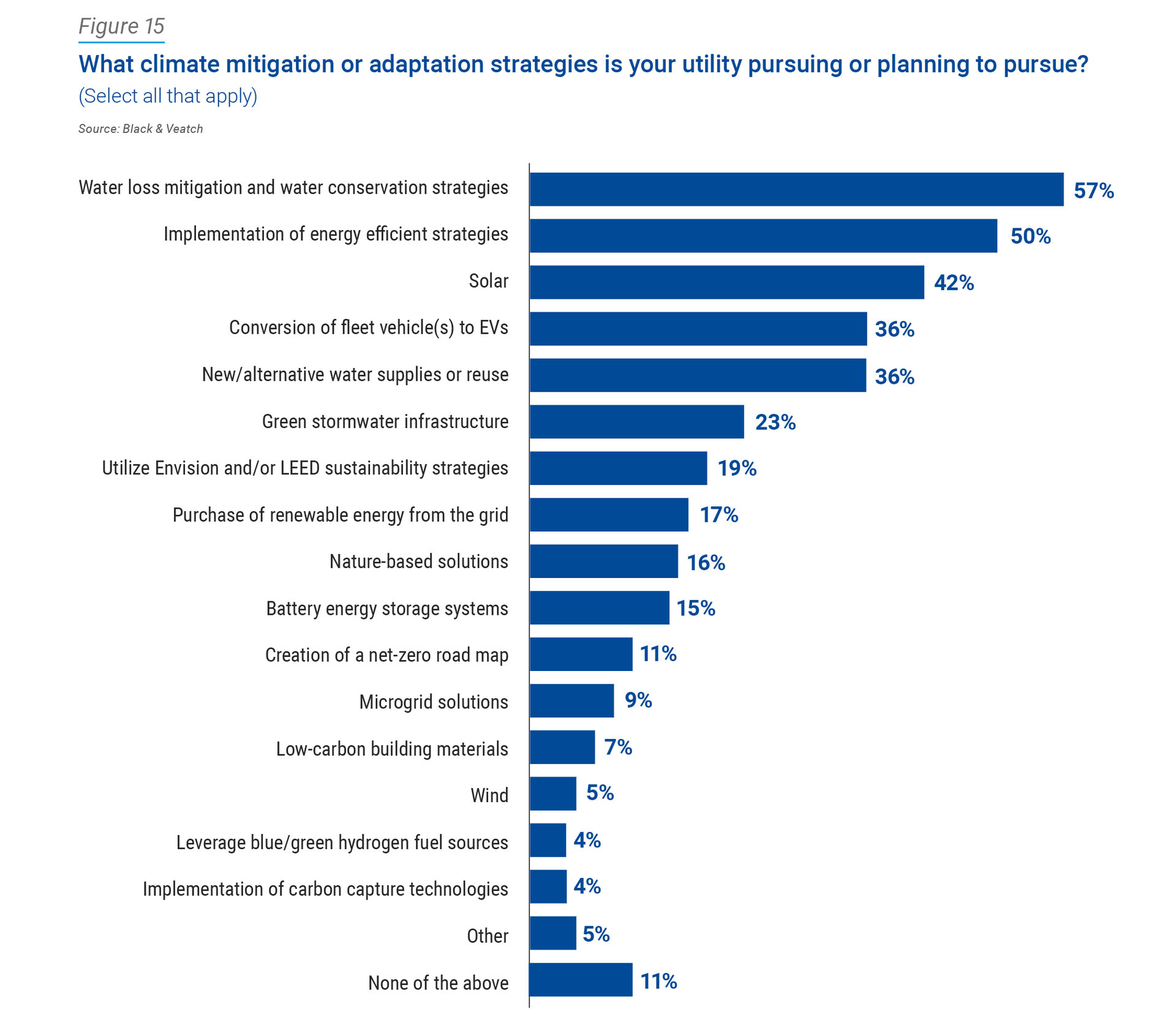

When asked what type of climate mitigation or adaptation strategies they have pursued or planned to initiate, water loss mitigation and water conservation strategies emerged as the top choice (57 percent). Only 11 percent said they are not pursuing any of the more than a dozen possible responses from which to choose (Figure 15).

Given that water infrastructure is energy intensive, utilities must ensure a reliable power supply that also is more efficient and renewable to bolster resilience and sustainability. Water utilities appear to understand that, explaining why implementation of energy efficient strategies (50 percent) remained the second ranked climate-related strategy on utilities’ radar, followed by use of solar power (42 percent); the decarbonization play of converting fleet vehicles to electric vehicles (EV) (36 percent) and new or alternative water supplies and water reuse (36 percent).

As an example for converting fleet vehicles to EVs, Black & Veatch recently was selected by Helix Water District in San Diego County, California, to perform design and engineering services for the district’s EV charging infrastructure project that will allow Helix to convert its fleet of utility vehicles to EVs in the coming years with a reliable, resilient charging solution. California’s Advanced Clean Fleets regulation related to EVs is among the country’s most aggressive, requiring half of all state and local government fleet purchases of medium- and heavy-duty vehicles to be zero-emissions or near zero- emissions by the end of 2024 — and 100 percent by 2027.

Sustainability Protects Future Generations

More than six in 10 respondents (61 percent) consider sustainability to be a critical strategic focus, with nearly half (49 percent) highlighting that their organization has specific sustainability goals and performance metrics.

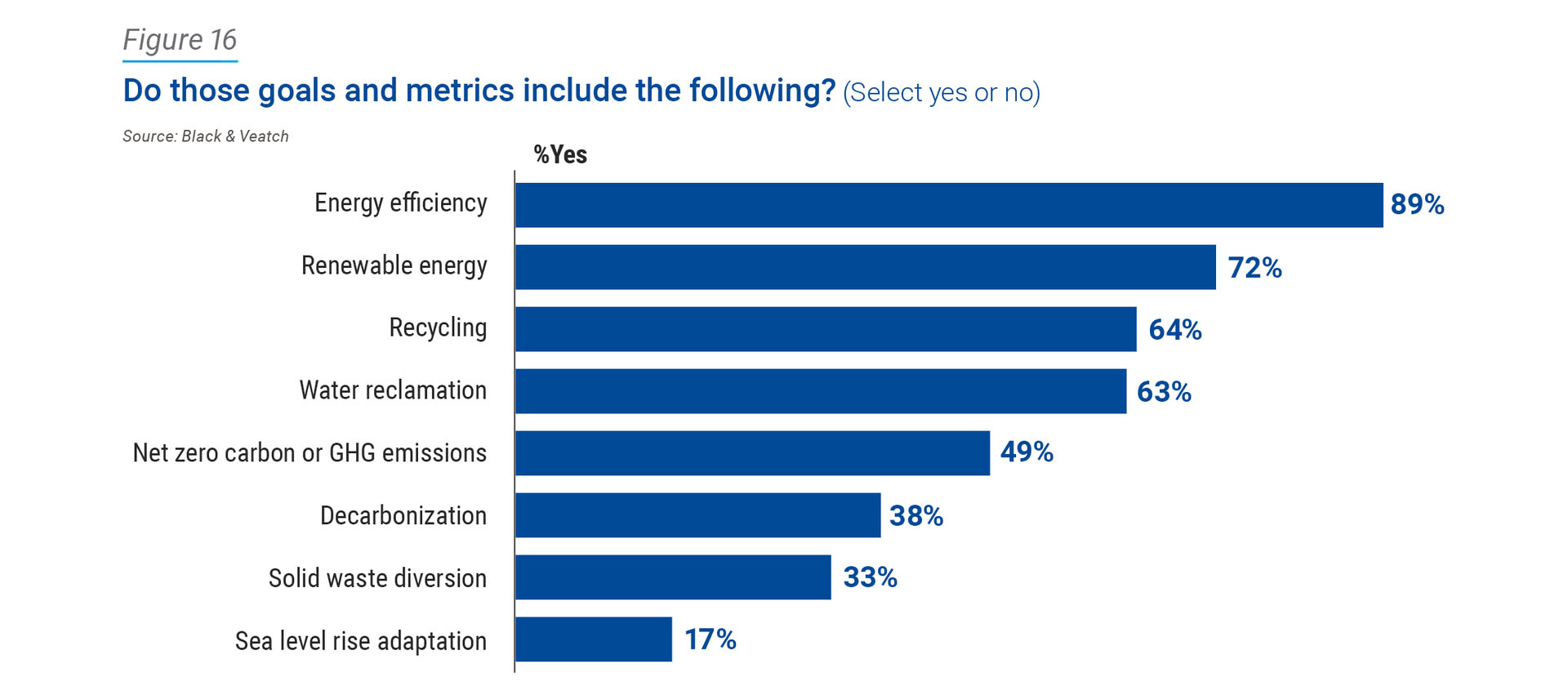

Three-quarters of larger water enterprises — those serving more than 500,000 people — reported having sustainability goals and metrics, nearly twice the rate of their smaller counterparts (40 percent). For those enterprises with sustainability targets and measurements, respondents overwhelmingly said those initiatives included energy efficiency (89 percent) and renewable energy (72 percent), followed by recycling, water reclamation, net zero emissions and decarbonization (Figure 16).

Most of these objectives note a target completion date of six to 10 years down the road (33 percent), while 13 percent envision that timeframe as being within five years. From a regulatory standpoint, this falls within many governmental parameters; entities required to make major changes often are given a 10-, 15- or 20-year lead time to get funding and infrastructure improvements in place.

When asked what sustainability-enhancing tactics utilities are practicing, asset management led the way at 65 percent, followed by water conservation initiatives, operational efficiency, proactive replacement of infrastructure, energy efficiency initiatives and nutrient removal.

Decarbonization Still Lags

Decarbonization — ostensibly any approach that directly cuts greenhouse gas (GHG) emissions — still has hurdles to overcome to gain traction in the water industry. While nearly half (47 percent) of respondents said they have no decarbonization plan, that doesn’t mean they won’t be cutting GHG emissions or energy use. For instance, they may be putting solar power to use, just not under the auspices of a formal decarbonization plan.

When asked about the biggest drivers for their decarbonization plan, one-third of respondents listed environmental benefits, while other categories such as resilience, cost savings, regulation, community and the desire to be a good citizen registered about half that response.

Hurdles to Sustainability

As the drive towards more sustainable practices accelerates, challenges to achieving those goals remain. The biggest: affordability, listed by threequarters (76 percent) of respondents, followed by the availability of resources and capacity (49 percent).

It’s worth noting that the Internal Revenue Service in recent months has issued tax guidelines and clarifications surrounding the Bipartisan Infrastructure Law enacted in late 2021.

As signaled by affordability concerns, access to federal, state and local funding becomes critical to furthering sustainability goals. Given the complex and evolving nature of these funding options, and the resource and capacity constraints within utilities, partnering with outside experts can be a game changer to secure a utility’s share of funding.

A Measured Approach

Utilities are navigating a period of significant investments to address rapidly growing demand and aging water infrastructure. The megatrend around sustainability creates both complexity as well as opportunity for utility leaders.

Utilities are responsibly starting with a focus on managing existing assets and operations to maximize efficiency and sustainability as indicated by our respondents. They also are considering new investments in solar, electric vehicles and charging infrastructure, and other sustainable infrastructure as climate mitigation strategies.

By working with experts such as Black & Veatch, they can develop an effective strategy and roadmap that enhances utility operations, promotes sustainability and resilience, and maximizes affordability for customers that includes leveraging the generational public funding opportunities that are available. As they consider these investments, it is imperative to future-proof in a way that supports achieving multiple objectives of reliability, efficiency and affordability through resilient, sustainable infrastructure.