As energy stewards, utilities continually strive to balance grid expansion needs with competing interests, including operating and managing aging infrastructure, renewable interconnection and improving resiliency and reliability.

Welcome to the world of “grid modernization,” which encompasses the frustration and promise of updating and hardening old infrastructure. This opportunity encompasses preparing for current and future threats — from the cyber-related to the outage-causing effects of a changing climate — while capitalizing on emerging opportunities.

What is the posture about grid modernization across America? Black & Veatch’s 2024 Electric Report — an expert analysis of a survey of nearly 700 U.S. electric sector stakeholders — provides many key answers.

The Surge of Renewables

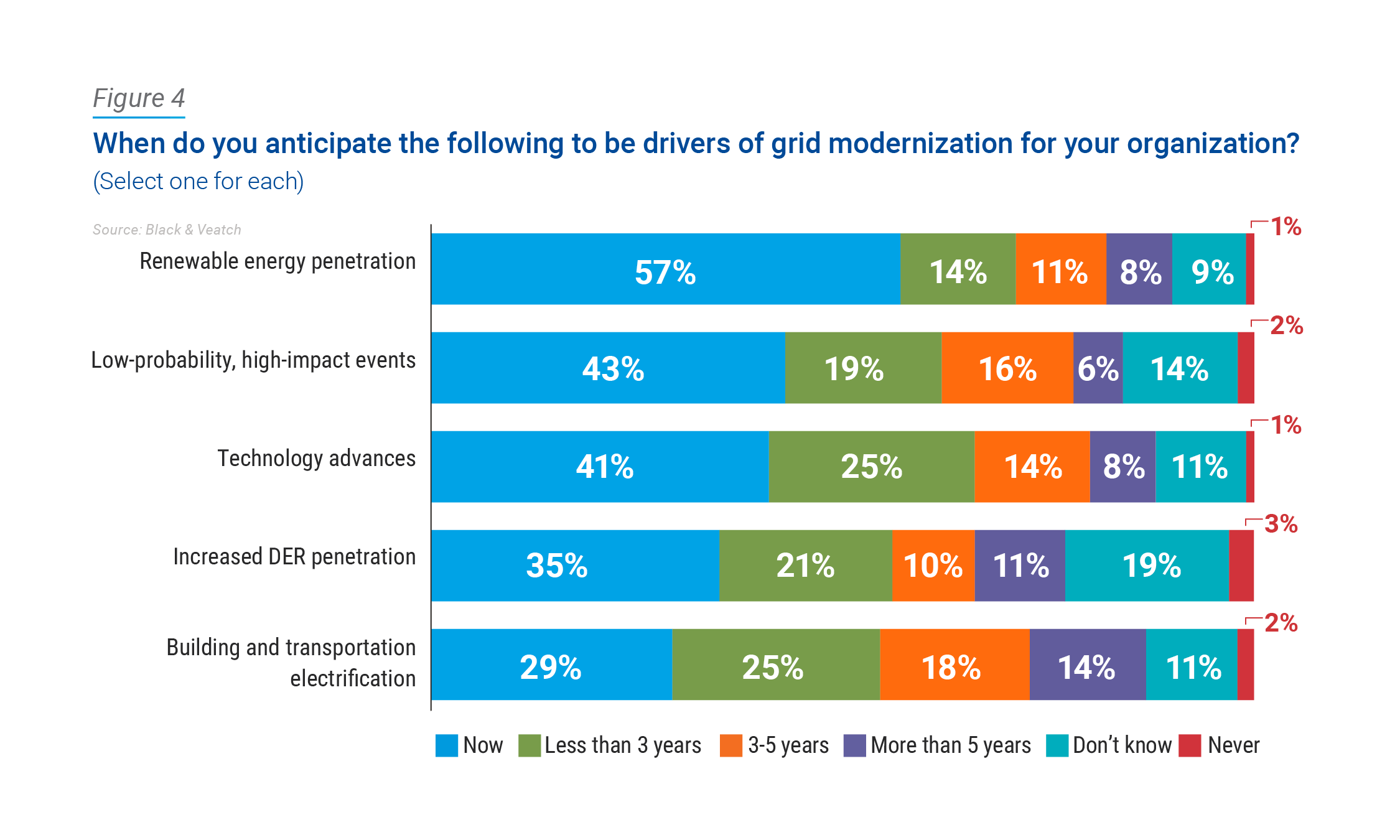

On the matter of when survey respondents anticipate various factors to be drivers of grid modernization for their organization, renewable energy penetration was listed as the most significant current driver at 57 percent, followed by low-probability/high-impact events (e.g., weather) at 43 percent (Figure 4). Renewable reliability at a large scale is an issue for utilities due to intermittency of renewable sources of power. Utilities want to be in control of their power availability, but as more distributed generation enters a system, it becomes harder to control

These concerns can be viewed from two perspectives. A distribution-only utility would view this question as a behind-the-meter application, whether it is microgrids or stand-alone distributed energy resources (DERs) such as rooftop solar. A transmission utility would see the issue from the perspective of dealing with large-scale solar and wind farms that seek to interconnect with the transmission system. In short, distribution system operators are focused on visibility and control, while transmission systems are concerned with having the necessary transmission capacity to operate.

It’s worth noting that building and transportation electrification garnered just 29 percent as a driver now, yet it appears to be the most significant issue on utilities’ radars in the next three to five years.

There is a lot of uncertainty surrounding electrification — exactly what it will look like and its resulting demands. But electrification is coming, with the only uncertainty being a matter of when. Some of the uncertainty is tied up in politics. In addition, electric vehicle (EV) demand has slowed — perhaps a reflection of high interest rates and the price point of such vehicles. But those declines are more than replaced by the energy-intensive requirements of data centers being built nationwide to support artificial intelligence applications.

Building electrification is moving forward in some regions, but pushback is rising in other areas of the country. For instance, where discussions are taking place about outlawing natural gas, some sentiments are developing against that notion. This is the conundrum in which utilities find themselves.

In general, utilities primarily are dealing with the problems directly in front of them and worrying less about what’s five or 10 years down the road, given ongoing expansion demands and operations and maintenance challenges. This isn’t surprising. Utilities have to report to regulators, and it’s difficult to convince them that now is the time to begin planning for the impacts of building and transportation electrification in the coming decade(s).

An Optimistic Future Concerning Regulations

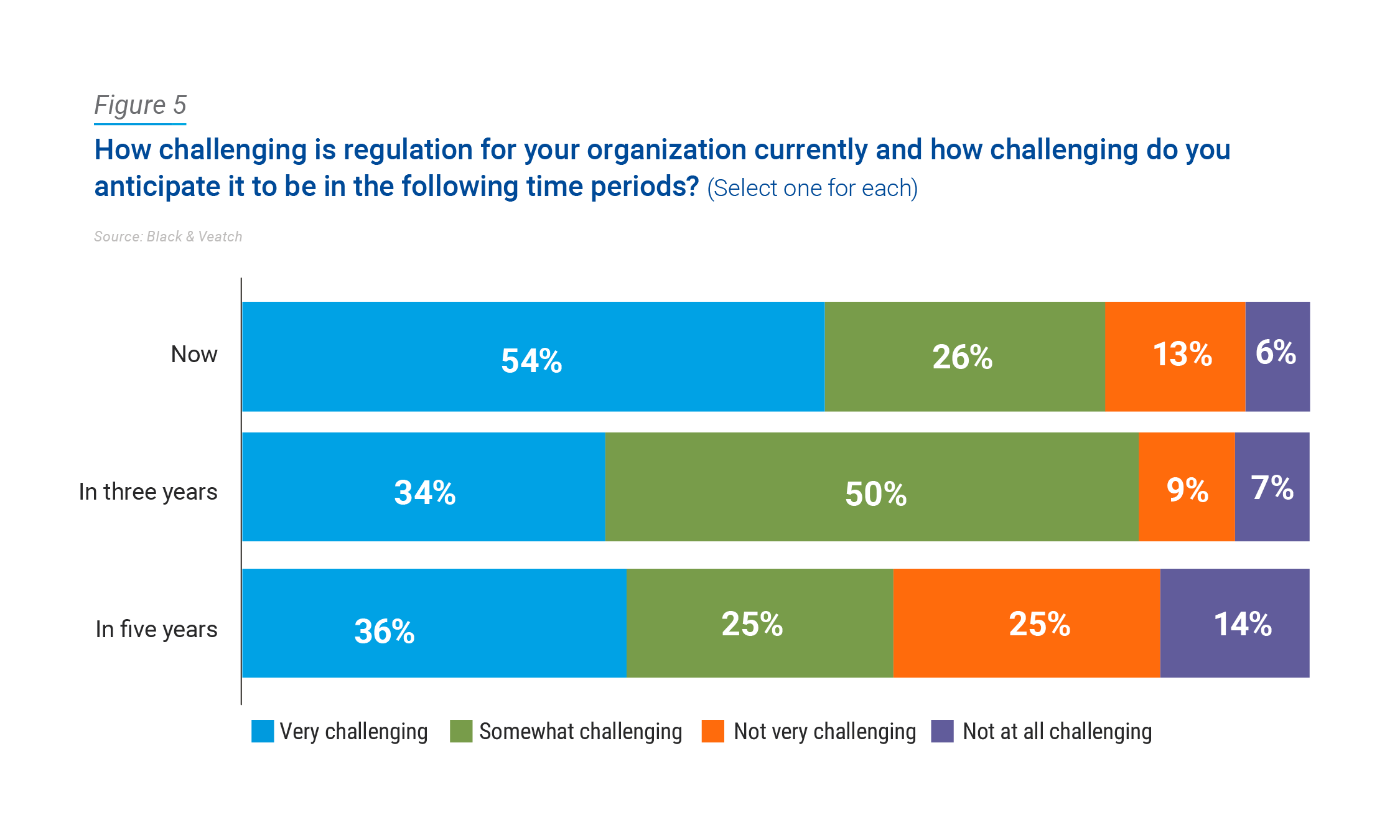

Survey respondents were asked about how challenging regulations are now — and their outlook for the future (Figure 5). More than half (54 percent) listed regulations as very challenging now, with an additional 26 percent saying they’re somewhat challenging. Interestingly, while a combined 80 percent find regulations very or somewhat challenging, that number drops to just 61 percent for five years from now.

While this outcome is hard to imagine in light of the constant battle over rate cases and various siting proposals, two Federal Energy Regulatory Commission (FERC) orders in early 2024 are considered positive signs.

One of those orders — No. 1977 — gives FERC siting authority for inter-regional transmission lines of national significance if the states don’t act — a substantial action in getting important transmission projects moving forward. There is a half dozen or more merchant transmission line proposals that have been in the works for more than a decade, yet they remain stagnant while waiting for state or local regulatory approvals.

The other FERC action, No. 1920, addresses longrange transmission planning and cost allocation. FERC’s goal is to have transmission owners build into their transmission plans the infrastructure needed to support renewables and increased load growth as opposed to having a more reactive response toward expansion. With the support of this FERC order, transmission owners and developers may be able to make a stronger case to their local public utility commissions (PUCs) versus PUC for future transmission siting and development.

The fact that FERC is trying to streamline regulations in these two important areas is a positive development.

The Battle for Funds

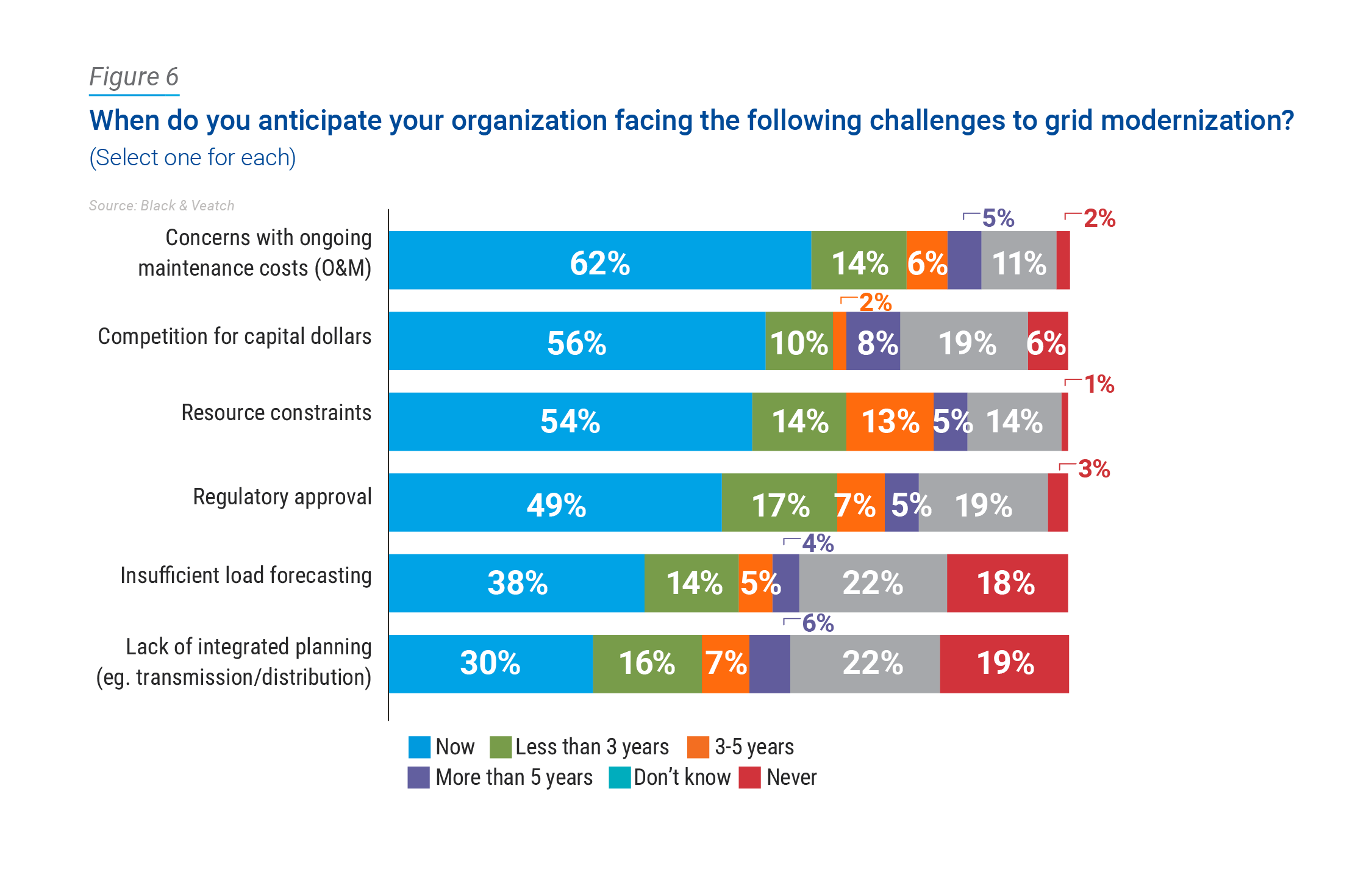

The need for capital expenditures (CapEx) continues to be a driver for all organizations. Furthermore, CapEx versus operations and maintenance (O&M) almost always is present as a potential conflict, given that funding new expansion (hence, additional revenue) can compete for money to maintain assets already in the field. Even though today’s CapEx eventually becomes tomorrow’s O&M, it may be hard to see behind all of the pressures utilities face today.

That said, O&M still came out on top by a narrow margin as the most significant challenge organizations face in modernizing the grid (Figure 6). Sixty-two percent of respondents listed concerns with ongoing maintenance costs as their most significant current challenge, compared with 56 percent that cited competition for capital dollars.

There are ongoing efforts to use technology to lessen O&M expenses. More extensive use of sensors to detect issues or flying drones for inspections are two examples of how utilities are trying to adopt new technology. The pressure to spend less on O&M to push those dollars to CapEx is likely increasing because of all the work that needs to be done on grid expansion to meet increasing load growth.

A Rapidly Changing Future

For decades, utilities have engaged in integrated resource planning (IRP), which is a long-range outlook of their region and the anticipated CapEx needs to meet projected changes. In the past, an IRP was updated every five or 10 years as growth was relatively flat, and the economics didn’t change. But many utilities today update their IRP every other year, or even annually. The increased frequency of updating IRPs is necessary due to the exponentially growing demands placed on the utility and the rising uncertainty associated with customer load growth due to growing data centers, domestication of clean tech and electrification.

As utilities keep one eye on the immediate future and the other on the coming decades, they must continually find the right balance for affordability, equitability, reliability and sustainability.