Anyone unversed in the rapid torrent of change in the U.S. water sector needs to only appreciate what the industry’s stakeholders considered their top headaches a few short years ago. Cited in 2019 by eight of 10 respondents to Black & Veatch’s survey for its assessment of the sector, aging infrastructure overwhelmingly ruled the roost, as it has in virtually all of the 13 editions of this yearly report. Justifying capital improvement plans and rate requirements, managing capital costs, system resilience, and data collection and management followed, none getting more than 26 percent of the vote.

Flash forward to these times, and the tide dramatically has turned.

Aging infrastructure in dire need of upgrades and investment remains the biggest headwind among nearly 630 survey respondents in this Black & Veatch 2024 Water Report. Then there’s the aging workforce and the hiring of qualified staff — what’s being dubbed an unfolding “silver tsunami” of retirements expected to deepen over the next 10 years. Throw in the uncertainty of an evolving, shifting regulatory landscape involving contaminants such as “forever chemicals,” lead and copper rules, the surge of cybersecurity threats, funding constraints, high energy costs, and the pressures for more sustainability and resilience in the face of growing climate change impacts.

While the already complex U.S. water, wastewater and stormwater sectors try to muscle through a tug of war of conflicting priorities, a pipeline of opportunity exists with the promise of digital technologies and innovations leading the list of ways in which operators can make better decisions and get the most of their graying assets and limited resources.

Integrated water solutions — with a “One Water” understanding that all forms of water are a singular resource to be managed sustainably — hold growing influence in helping reshape the water sector eager to achieve enhanced sustainability and system resilience.

Aging Infrastructure, Other Challenges Abound

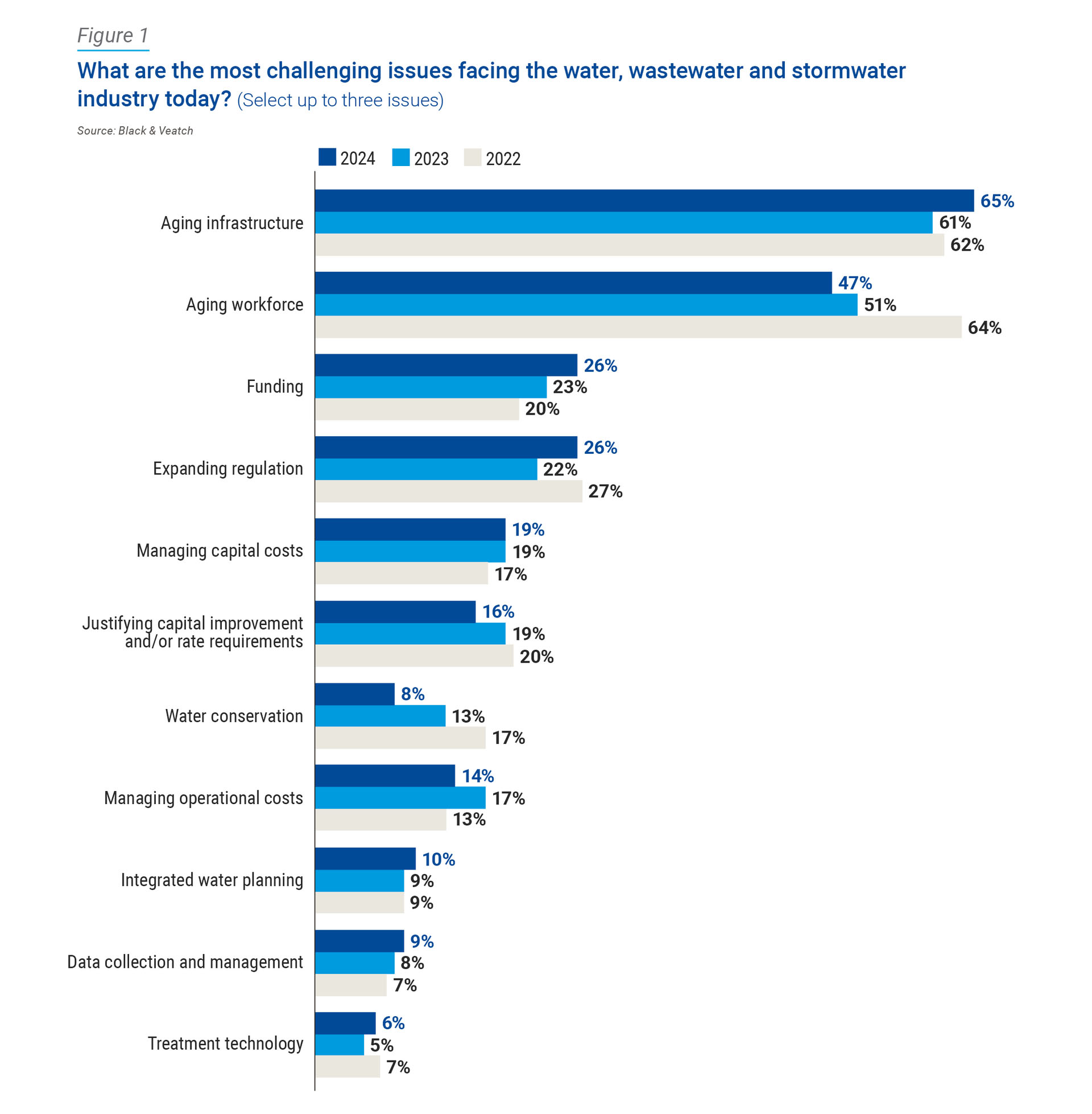

In a fragmented industry with more than 50,000 water utilities and 16,000 wastewater utilities in the United States, there may be a time when aging infrastructure doesn’t top the list of headaches, but it’s unlikely to come soon. Roughly two-thirds of survey respondents (65 percent) cited that issue as their foremost challenge, a few percentage points higher than the previous two years but still easily at the top of the heap (Figure 1).

The matter of the aging workforce and the challenge of hiring qualified staff remains in the top two for the third consecutive year at 47 percent, down from 51 percent in 2023. This is a dramatic improvement from 2022 (64 percent), when COVID-19’s impact included forcing droves of workers to go remote or, in scores of cases, retire altogether as increased adoption of automation and outsourcing filled some of the gaps. That exodus is expected to worsen, with federal estimates that one-third of water utility workers could call it a career in the next decade.

When it comes to hiring staff in a sector where trained operators are crucial in satisfying the mission of capturing, treating and delivering water, the dilemma remains: qualified candidates have more options and bargaining power in an intensely competitive job market. That’s putting a strain on utilities with limited financial resources, especially the smaller ones. Hoping to assist, the U.S. Environmental Protection Agency last year announced the availability of more than $20 million in grants to support training and career opportunities for water and wastewater workers nationwide.

Money matters naturally never stray from being close to top of mind. Funding or availability of capital — along with growing regulation — tied at 26 percent for third place on the dreaded headache list, with managing capital costs (19 percent), justifying capital improvement programs and rate requirements (16 percent), and managing operational costs (14 percent) also all among the list’s top 10.

Respectively, four in 10 respondents don’t expect funding for capital infrastructure projects over the next five to 10 years to be enough; roughly a quarter said it’ll just meet the requirement (27 percent) or that funding will be sufficient (24 percent). Nearly half (45 percent) said they’ve pursued state and federal funding (including the Bipartisan Infrastructure Law), with an additional 39 percent saying they plan to do so.

Sustainability

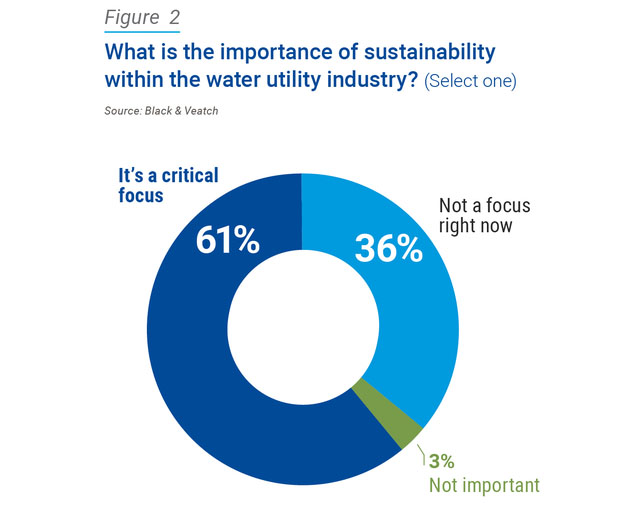

While sustainability means different things to different people, we see it as the need to serve the current generation while safeguarding the needs of future generations. And U.S. water utilities appear to be holistically embracing its importance, with six in 10 respondents casting it as a critical strategic focus, a slight drop from the previous two years but promising, nonetheless (Figure 2). Three-quarters of larger utilities — those serving a population of more than half a million — hold that view.

About half of respondents report that their utility has sustainability goals and the means to measure them, in line with last year (51 percent). Three-quarters of larger utilities — those with at least 500,000 customers — say they’ve got such targets and the related metrics, up from 67 percent just a year ago. By comparison, just 40 percent of smaller utilities say they have a sustainability game plan.

Components of those goals and metrics have shuffled a bit over the past year. While energy efficiency (89 percent) leads the way, renewable energy has surged to second (72 percent), overtaking water recycling (64 percent, up from 56 percent in 2023) and water reclamation (relatively unchanged at 63 percent). None of the other survey options — net zero carbon or GHG emissions, decarbonization, solid waste diversion or sea level rise adaptation — drew more than 50 percent.

Wondering about the time horizon for those with sustainability goals to achieve them? Quick answer: it won’t be soon, with one-third of respondents giving an outlook of six to 10 years, with just 13 percent saying it’ll happen within the next half decade. One-quarter (26 percent) don’t know.

Digital Water

For years, these Black & Veatch reports have evangelized all that data can do through next-generation collection devices and predictive analytics. So-called “digital water” boasts the ability to funnel disparate data into a single, meaningful snapshot of the entire water ecosystem, giving insight into the system’s connectivity and synergies to drive operational efficiency, performance predictability and maintenance planning while optimizing workforce needs.

Simply put, data in a sector where many utilities grapple with trying to do more with less has the power to understand, manage and guide reliability and optimize asset performance, with smart infrastructure the key to overcoming the many threats to our water supply. Other benefits include precise reads of consumption and customer engagement and leak detection.

So where are today’s U.S. water utilities on the data journey? Not where they need to be, and for that they’re missing out. Six in 10 respondents say they’re collecting lots of or some data but not leveraging it effectively. And just 4 percent of respondents say their data or digital solutions are achieving all of their strategic objectives; 18 percent say they’re hitting most of their targets, while one in four say they’re achieving some.

While funding issues lead the list of reasons why respondents haven’t adopted digital solutions, a majority of those with a data-related gameplan say asset monitoring, measurement and analysis — along with cybersecurity — are their top objectives, followed distantly by operations planning and control, then monitoring and compliance (Figure 3).

Cybersecurity

In a March 2024 letter, the Biden administration asked all governors to bolster security in their states for water and wastewater systems, warning that “disabling cyberattacks” are targeting utilities across the country, with the trend threatening to “impose significant costs on affected communities.”

“Drinking water and wastewater systems are an attractive target for cyberattacks because they are a lifeline critical infrastructure sector but often lack the resources and technical capacity to adopt rigorous cybersecurity practices,” reads the letter signed by EPA Administrator Michael Regan, whose agency also has formed a task force to identify vulnerabilities in the water sector.

Water utilities understand the gravity, with more than eight of 10 respondents to Black & Veatch’s survey casting cybersecurity investment as “very important” in safeguarding their assets. Yet nearly 40 percent say they have cyber protocols in place but recognize gaps may exist with field devices and hosted solutions.

What’s more, two-thirds of respondents prefer that they govern their cybersecurity themselves, down from more than 70 percent over the previous two years.

As increasingly connected, digitized infrastructure presents new openings to cyber attackers while spurring utility stakeholders to reassess their security needs, decision-makers are well-served seeking outside guidance and solutions from such experts as Black & Veatch, which recently launched its global industrial cybersecurity business that the times demand.

The Pressing Need for Action, Change

As the headwinds whirl, the industry on many metrics appears to be better positioning itself against the challenges of the times, either independently or with outside guidance. Central to it all is addressing the need for infrastructure and technology investments while unleashing digital solutions that help abate water waste from aging, leaky pipelines, mitigate climate change fallout and pesky contaminants, and bolster water reuse while maneuvering the confines of rates and regulation.

Slowly but surely, U.S. water utilities are discovering and pursuing new ways of doing business by leveraging integrated approaches to both planning and delivering strategic, financial and operational resilience.

With innovation knocking, the sector has an opportunity to be an agent of change. Because this age of rapid change demands it.